What to Know About Filing an LP as a Foreign Entity

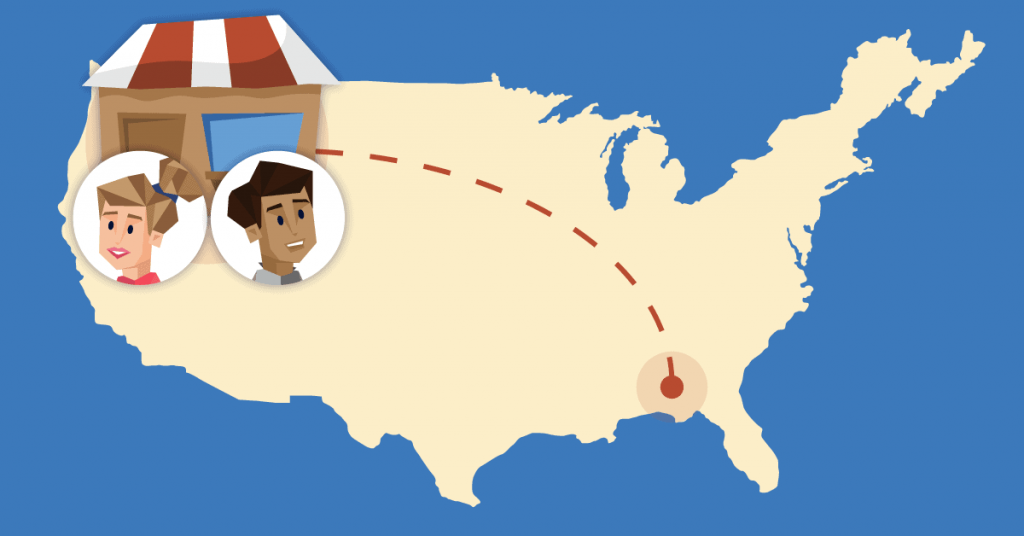

Registering your business in another state (a process known as “foreign qualification”) is important if you want to conduct business there. Businesses from corporations and LLCs to limited partnerships (LPs) can register as a foreign entity.

What is a foreign entity?

A foreign entity is a business that operates in a state other than the state in which it was formed. So, in a business sense, “foreign” just means out-of-state. For example, if you started a restaurant called “Burger Hut” in Idaho and it’s doing so well you want to open another “Burger Hut” in Montana, you would would have to register for foreign qualification in Montana before you sold any burgers there.

What is a limited partnership?

A limited partnership (LP) is a type of business with two types of partners: general partners and limited partners. The general partner is primarily responsible for the business, from managing day-to-day operations to taking on any business debt. The limited partner is typically a silent partner, responsible for funding operations but little else.

How can an LP register for foreign qualification?

The process of obtaining foreign qualification may look a little different in each state. But in general, the process is relatively straightforward:

- Check for name availability

- Secure a registered agent

- Obtain a certificate of good standing

- File your foreign qualification form

In some states, the foreign qualification form is known as an “application for certificate of authority” and in others it’s known as a “foreign registration statement.” Check with the secretary of state’s office in the state you intend to do business to make sure you have the right form.

You can read more about the foreign qualification process—and how it differs in each state—by visiting Northwest’s Register a Business in a New State page.