LLC Resolution To Open A Bank Account Free Template

An LLC resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of a limited liability company. Your bank may require a resolution if your Articles of Organization or operating agreement don’t specifically authorize someone to open an account. We offer a free template for an LLC resolution to open a bank account.

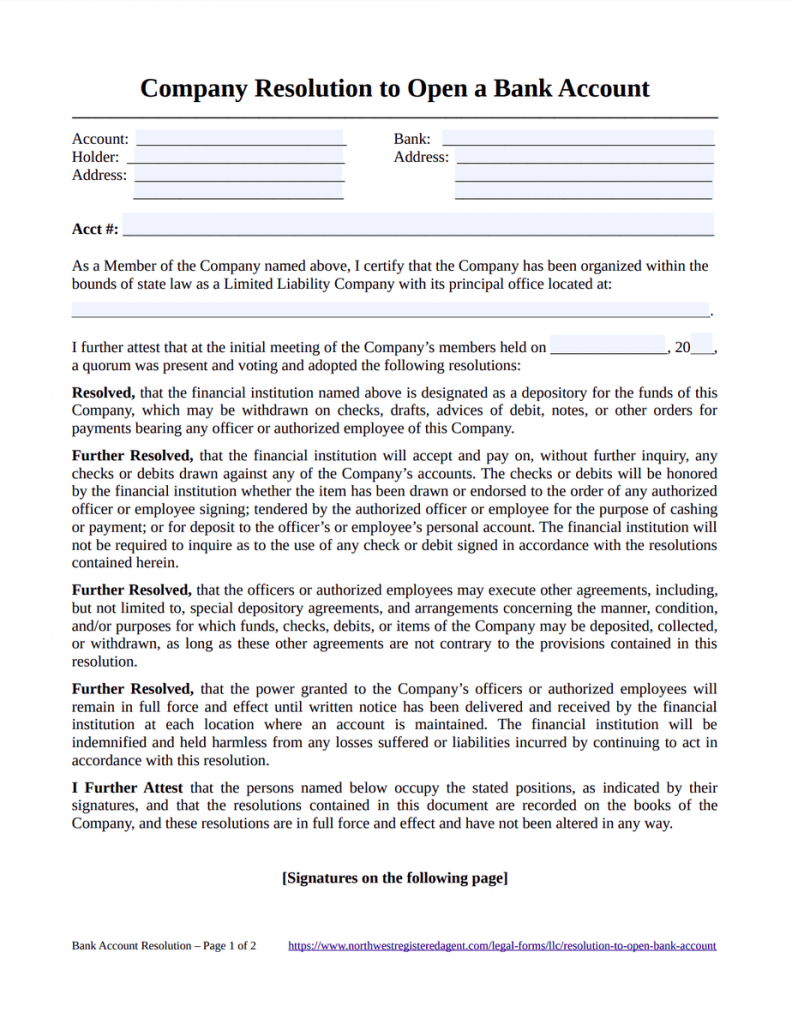

Open an LLC Business Bank Account – Free Resolution

Maybe your LLC’s operating agreement doesn’t mention the ability of a member to open an LLC bank account. Maybe it does—but your bank is just being annoying, requesting that you show a resolution granting you the power to open a bank account in the name of your LLC. For these situations, we’ve got the form you need.

Just fill in the information requested in the blanks, sign and date the resolution, and you should be able to open a bank account for your LLC, hassle-free. Like all our forms, this document is intended for individual use.

Opening a bank account is a key part of starting your LLC, but of course, there’s much more to do. At Northwest, we can help. We offer registered agent service for LLCs in every state. You can even hire us for state annual report compliance. We also form LLCs for $100 plus state fees.

Let Us Help You Maintain Your LLC!

What should a resolution to open a bank account include?

Your resolution needs to include information about the LLC, the bank, the account and the authorized users. You’ll need to explain exactly what actions are authorized and how changes can be made. In short, there’s a lot of ground to cover—luckily, our free LLC bank account resolution is comprehensive and easy to use.

Our resolution includes spaces to enter the following information:

-

LLC name and address

-

Bank name and address

-

Bank account number

-

Date of meeting when resolution was adopted

-

Certifying signature and date

The text of the resolution itself contains statements certifying the following:

-

the LLC has been organized under state law

-

the resolution was adopted at a meeting with a quorum of LLC members

-

the resolution is unaltered, in effect, and recorded in the LLC’s books

-

the bank has been designated as a depository for LLC funds

-

any officer or authorized employee of the LLC may deposit or withdraw from the fund without further confirmation from the bank

-

officers or authorized employees can also arrange for funds to be collected, deposited or withdrawn in a specific manner, under a certain condition or for a specific purpose

-

these powers remain in effect until the LLC provides written notice of change

-

the bank is indemnified for liabilities incurred by acting according to the resolution