How to Reinstate a Texas LLC

To revive a Texas LLC, you’ll need to file either an Application for Reinstatement and Request to Set Aside Tax Forfeiture (Form 801) or a Texas Certificate of Reinstatement (Form 811) with the Texas Secretary of State. You’ll also have to fix the issues that led to your Texas LLC’s termination and obtain a Texas tax clearance letter from the Comptroller of Public Accounts. Below, we provide a free, step-by-step guide to reinstating your Texas LLC.

Revive A Texas Limited Liability Company

The Texas Secretary of State has the power to administratively terminate or forfeit your LLC if you fail to do any of the following:

- file annual reports

- file and pay the annual Texas franchise tax

- appoint and maintain a registered agent

- pay filing fees

To get your Texas LLC back into business, you can apply for reinstatement. Texas has two reinstatement forms. The one you’ll use depends on why your Texas LLC was terminated.

If your LLC was terminated for failing to pay the Texas franchise tax, you’ll need to file The Application for Reinstatement and Request to Set Aside Tax Forfeiture (Form 801).

If your LLC was terminated for any other reason, you’ll need to file the Texas Certificate of Reinstatement (Form 811).

In either case, you’ll also need to submit the following to the Texas SOS:

- a Texas tax clearance letter from the Comproller of Public Accounts

- a Texas LLC amendment (if needed to change your LLC’s name or registered agent)

- any owed fees or penalties

Reinstating a Texas LLC is a process with multiple steps that can’t all be completed in one day. You should start by requesting a Texas tax clearance letter from the Texas Comptroller of Public Accounts.

Texas Tax Clearance

How do I get a Texas tax clearance letter?

There are two ways to request a Texas tax clearance letter:

- Online via the Comptroller’s Webfile system

- By mailing a Tax Clearance Letter Request for Reinstatement form to the Texas Comptroller of Public Accounts

Online requests require a franchise tax Webfile (XT) number. You can request one by calling the Comptroller’s office at 1-800-442-3453 and providing some confidential information.

How long does it take to get a Texas tax clearance letter?

Online requests are processed immediately, while mailed requests take 3-4 weeks to process (assuming you’re caught up on Texas franchise tax payments).

What information do I need to complete the Texas Tax Clearance Letter Request for Reinstatement?

The Tax Clearance Letter Request for Reinstatement form requires your Texas LLC’s name and its 11-digit Texas taxpayer number.

You’ll also need to check a box indicating how you’d like the Texas tax clearance letter delivered to you (by fax, email, or mail) and provide a number, email address, or mailing address.

Requesting a Texas tax clearance letter is free, but you won’t receive one unless you’re current on all taxes, penalties, and returns. If you’re not, include the missing payments and returns with this form.

Reinstate your Texas LLC

Once you have a Texas tax clearance letter, you’re ready for the next step towards reinstating your Texas LLC: filing a reinstatement application with the Texas Secretary of State.

What form do I use to reinstate my Texas LLC?

In Texas, there are two forms used to reinstate a terminated or forfeited LLC. The one you need to file for reinstatement depends on why your LLC was forfeited.

For an LLC that was terminated for failure to pay the Texas franchise tax, file Form 801 – Application for Reinstatement and Request to Set Aside Tax Forfeiture.

For an LLC terminated for failure to appoint/maintain a registered agent, file annual reports, or pay filing fees, use Form 811 – Certificate of Reinstatement.

Both forms must be submitted in duplicate and include your Texas tax clearance letter.

What information do I need for The Application for Reinstatement and Request to Set Aside Tax Forfeiture (Form 801)?

Form 801 requires your Texas LLC’s name, SOS File Number (this is optional but can speed up the process), and the date of forfeiture.

The form also includes a statement affirming that you’ve filed all your late annual reports and payed all owed taxes. A member or a manager will need to sign it.

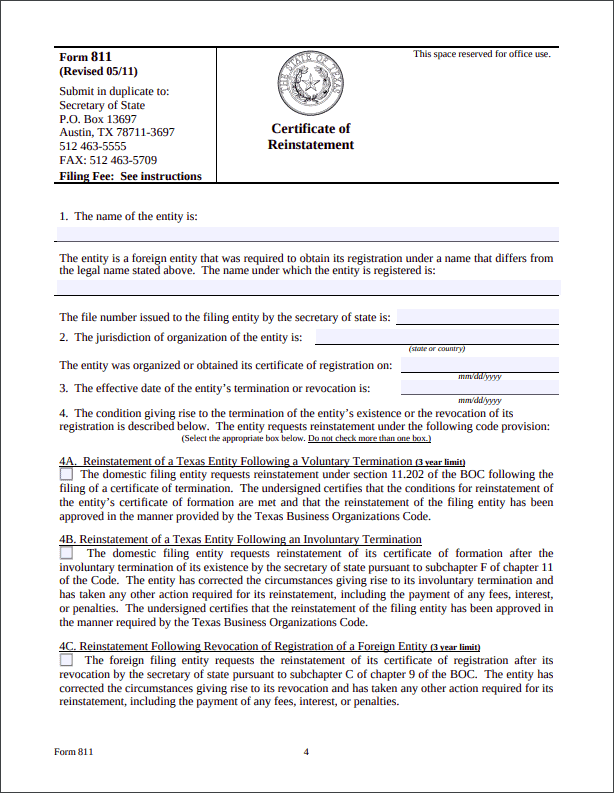

What information do I need for the Certificate of Reinstatement (Form 811)?

To complete Form 811, you’ll need to list the name of your Texas LLC, the Secretary of State filing number, the county or state where your Texas LLC was formed, the date of formation, the date your LLC was terminated, and your registered agent’s name and address.

You’ll also need to check a box that indicates why your Texas LLC was terminated. If the SOS terminated your Texas LLC for failing to file the annual report, appoint and maintain a registered agent, or pay a filing fee, check box 4B. Checking the box affirms that you’ve fixed the problem that led to forfeiture.

This form can also be used to reinstate a Texas LLC that was voluntarily terminated, as long as it hasn’t been more than three yearssince dissolution (check box 4A).

Form 811 must be signed by a manager, member, or person authorized to do business on behalf of the Texas LLC.

What if my Texas LLC’s name was taken while it was forfeited?

If another company adopted your Texas LLC’s name while it was forfeited, you’ll need to choose another name and submit a Texas LLC amendment with Form 801 or Form 811.

Can you change your Texas registered agent on the Texas reinstatement?

It depends. If your Texas LLC was terminated because of an issue with your registered agent, you can change your Texas registered agent on Form 811. Otherwise, you’ll need to file an amendment to change your registered agent with your reinstatement application.

How much will it cost to revive a Texas LLC?

Both forms cost $75 to file. You can expedite for an extra $25. If you need to file an amendment to change your name or registered agent, that will cost another $150.

How long does it take the Texas SOS to reinstate an LLC?

The Texas Secretary of State’s office typically processes filings in 5-7 business days. Expedited filings are usually processed in 1-2 business days.

How long do you have to revive a Texas LLC?

You can revive a business that was involuntarily terminated at any time. If you dissolved your Texas LLC voluntarily, you only have three years to reinstate it. After that, you have to form a new Texas LLC.

How do I file Texas Form 801 or 811?

You can submit both Texas Form 801 and Form 811 to the Texas Secretary of State by mail, in person, or by fax. Payment options depend on how you plan to file:

- Mail: Credit card, the LegalEase deposit system, check or money order

- Fax: Credit card

- In Person: Credit card, the LegalEase deposit system, check, money order, or cash

Filings paid by credit card must include Form 807. Checks and money orders should be made payable to “Secretary of State.”

Where do I submit my Texas Form 801 or Form 811?

Texas reinstatement applications are processed by the Secretary of State.

Mailed Filings:

P.O. Box 13697

Austin, TX 78711

Faxed Filings:

(512) 463-5709

In-Person Filings:

James Earl Rudder Office Building

1019 Brazos St.

Austin, Texas 78701