How to Reinstate a Rhode Island LLC

To revive a Rhode Island LLC, you’ll need to file any missing annual reports and amendments. You’ll also have to obtain a Letter of Good Standing from the Rhode Island Division of Taxation. Below, we provide a free, step-by-step guide to reinstating your Rhode Island LLC.

Revive A Rhode Island Limited Liability Company

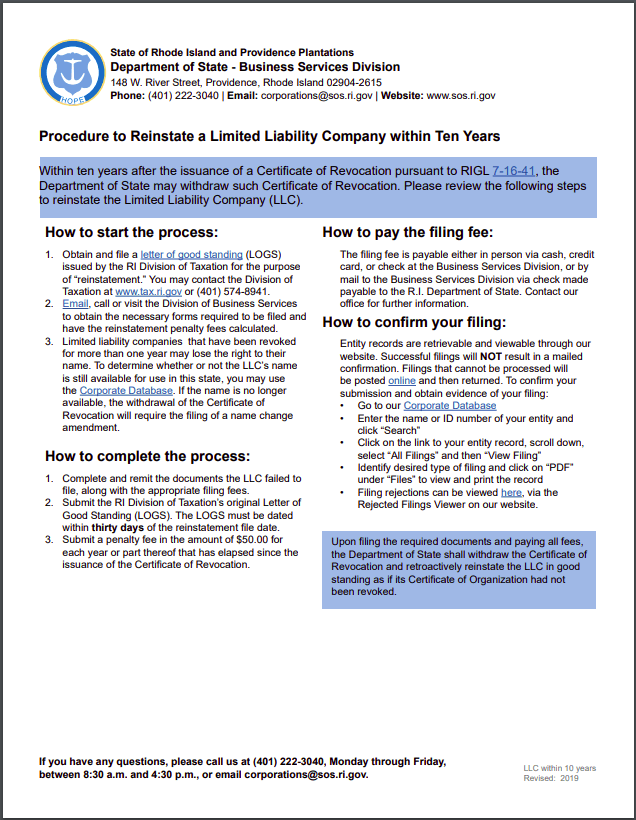

The Rhode Island Department of State has the power to administratively dissolve or revoke your LLC of you fail to do any of the following:

- file annual reports

- appoint and maintain a registered agent and registered office

- pay fees, penalties or taxes

Rhode Island doesn’t require you to fill out a reinstatement application to get back into business. Instead, you’ll need to submit the following to the Rhode Island Department of State:

- a Letter of Good Standing from the Rhode Island Division of Taxation

- any missed annual reports and amendments

- a penalty of $50 for each year your LLC was revoked plus any owed filing fees

The first step in reinstating a Rhode Island LLC is requesting a Letter of Good Standing. You can’t file the other documents until you have one.

Rhode Island Letter of Good Standing

When your Rhode Island LLC is administratively revoked, the SOS requires a Letter of Good Standing from the Rhode Island Division of Taxation stating that your LLC is current on taxes.

How do I request a Rhode Island Letter of Good Standing?

First, you’ll need to pay any taxes you owe. Then you can complete and submit the Rhode Island Request for Letter of Good Standing form to the Rhode Island Division of Taxation.

What information do I need to request a Rhode Island Letter of Good Standing?

The Rhode Island Request for a Letter of Good Standing form is eight pages long, but LLCs only need to fill out a few sections.

On the first page, you’ll need to provide the name of a contact person. This person must be a member or someone given power of attorney. The first page also requests basic information about your LLC, including its name, address, FEIN, Secretary of State ID number, the date its fiscal year ends, and the entity type (“Limited Liability Company”).

The next five sections (pages 2-4) list all the reasons a business in Rhode Island might request a Letter of Good Standing. You’ll need to check the box indicating the reason for your request.

- If your LLC was canceled because you failed to pay taxes, select “Reinstatement of charter forfeited by Rhode Island Division of Taxes.”

- If your LLC was revoked for any other reason, check “Reinstatement of charter revoked by the Secretary of State.”

Next, you can skip to page 4 and complete Schedule A. You’ll need to list the names and social security numbers of all your LLC’s members.

On page 5, you can list the information for a second contact person, but it’s not required. You can also provide a second mailing address if you’d like your Letter of Good Standing mailed to a different address than the one you listed on page 1. Page 5 must be signed by the contact person (a member or someone with power of attorney) listed on the first page.

If you have any overdue tax payments and returns, you’ll need to attach those to the request.

How do I submit the Request for Letter of Good Standing form?

You can only submit the Rhode Island Request for Letter of Good Standing by mail or in person.

How much does it cost to request a Letter of Good Standing in Rhode Island?

The RI Division of Taxation charges $50 to process a Request for Letter of Good Standing form. You can pay by check or money order made payable to “RI Division of Taxation.”

How long does it take to get a Letter of Good Standing in Rhode Island?

It usually takes the Division of Taxation about one month to issue a Letter of Good Standing. Expedited service is not available.

Once you get it, you only have thirty days to file for reinstatement before you have to start over and request another Letter of Good Standing.

Where do I submit my Request for a Letter of Good Standing?

The Letter of Good Standing is issued by the Rhode Island Division of Taxation.

Letter of Good Standing

Compliance & Collections

Rhode Island Division of Taxation

One Capitol Hill

Providence, RI 02908

Rhode Island LLC Reinstatement

Once you’ve received your Rhode Island Letter of Good Standing from the Division of Taxation, you can move on to the next step: reinstating your LLC.

How do I reinstate a Rhode Island LLC?

Rhode Island doesn’t require an application for reinstatement. Instead, you only need to file the forms you failed to file in the first place.

You’ll need to contact the Rhode Island Division of Business Services to find out which forms to complete and for an exact calculation of your reinstatement penalty. You can email, call, or stop by in person to ask.

Rhode Island Division of Business Services

Phone: (401) 222-3040

Email: corporations@sos.ri.gov

Address: 148 W. River St. Providence, RI 02904

Once you know which forms the Division of Business Services needs in order to reinstate your LLC, you can file them in person or by mail. You’ll also need to attach your Letter of Good Standing to your reinstatement filings.

Important: the Letter of Good Standing must be dated within 30 days of your reinstatement filings.

Can you change your registered agent on the Rhode Island reinstatement?

There’s no reinstatement application in Rhode Island, but you can change your Rhode Island registered agent by filing a Statement of Change ($20) when you reinstate.

What if my Rhode Island LLC’s name was taken while it was revoked?

Your Rhode Island LLC’s name is reserved for one year from the date of revocation. After that, the name becomes available for other business to adopt. You can find out if your name is still available with a quick search of the RI Corporate Database. If your name is being used by another business in Rhode Island, you’ll have to file a Rhode Island LLC amendment to change it when you reinstate.

How long do you have to revive a Rhode Island LLC?

You can revive a business in Rhode Island within ten years of revocation. After ten years, you can still reinstate, but the process becomes much more difficult. You’ll need to ask a senator to pass legislation or petition the Superior Court to issue a court order that reinstates your LLC.

How much does it cost to reinstate a Rhode Island LLC?

It costs $50 to request a Letter of Good Standing. You’ll also need to pay a $50 penalty for every year (or part of a year) that your LLC was revoked. You may also owe other filing fees. The Division of Business Services can calculate your exact bill.

How do I file for reinstatement?

You can file the forms and pay the filing fees in person or by mail. Payment options depend on how you plan to file:

Mail: Check (payable to “R.I. Department of State”)

In person: Cash, credit card, or check