How to Reinstate a Maryland LLC

To revive a Maryland LLC, you’ll need to file the Articles or Certificate of Reinstatement with the Maryland State Department of Assessments and Taxation (SDAT). You’ll also have to fix the issues that led to your Maryland LLC’s dissolution and, in some cases, obtain a Maryland tax clearance certificate. Below, we provide a free, step-by-step guide to reinstating your Maryland LLC.

Revive a Maryland Limited Liability Company

The Maryland Secretary of State has the power to administratively dissolve or forfeit your LLC if you fail to do any of the following:

- file annual reports

- file a Business Personal Property Return (if needed)

- appoint and maintain a registered agent

- reimburse SDAT for any checks returned due to non-sufficient funds.

The Secretary of State may also forfeit your Maryland LLC if you have an issue with the Maryland Office of the Controller or the Maryland Department of Labor, Licensing and Regulation.

In order to get back into business again, you can apply for reinstatement. To revive or reinstate your Maryland LLC, you’ll need to submit the following to Maryland’s State Department of Assessments and Taxation, Charter Division:

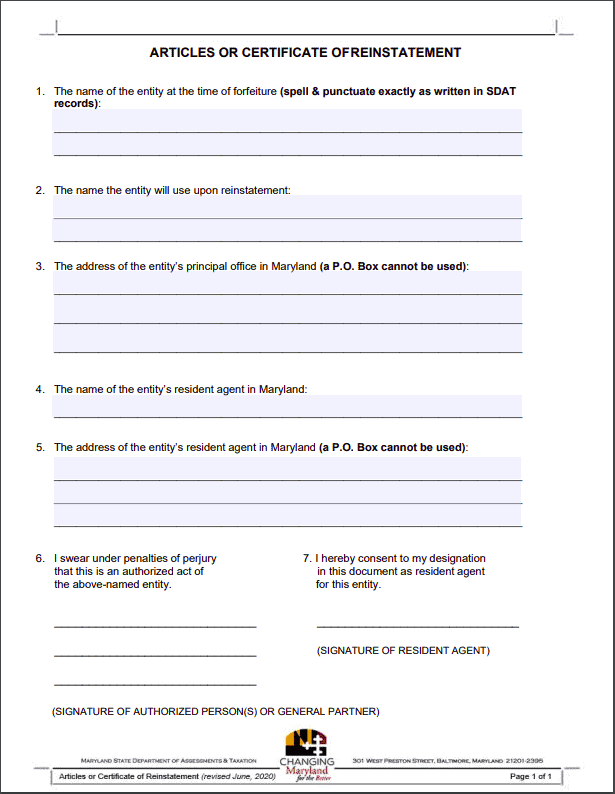

- a completed Maryland Articles or Certificate of Reinstatement form

- a tax clearance certificate issued by the city or county where your LLC owns property (if needed)

- any missing annual reports (including delinquent costs and fees)

- a $100 filing fee

What information do I need for the Maryland Certificate of Reinstatement?

To complete the Maryland Articles or Certificate of Reinstatement form, you’ll need to provide your LLC’s name at the time it was dissolved, a new name (if yours was taken), the address of your principal office, and the name and address of your resident agent.

The form must be signed by both your resident agent and a manager, member, or person authorized to do business on behalf of your Maryland LLC.

Your tax clearance certificate and any late annual reports must be attached to your application.

How do I file the Maryland Articles or Certificate of Reinstatement form?

You can submit the Maryland Articles or Certificate of Reinstatement to SDAT by mail, in person, or online. Payment options depend on how you plan to file:

- Mail: Check (payable to “State Department of Assessments and Taxation”)

- In person: Check, cash, or money order

- Online: Credit card, PayPal, or eCheck

Note: All online fillings are considered expedited and charged an extra $50. The service fee is 3% for PayPal and credit card payments and $3.00 for eChecks.

Where do I submit my Articles or Certificate of Reinstatement?

Reinstatement applications are processed by the Marlyand State Department of Assessment and Taxation (SDAT).

Mailed and In-Person Filings:

Charter Division

301 W. Preston Street; 8th Floor

Baltimore, MD 21201

Online Filings:

How much will it cost to revive a Maryland LLC?

The filing fee for a Maryland Articles or Certificate for Reinstatement is $100. The filing may be expedited for an additional $50 fee.

You’ll also need to pay any owed taxes.

How long does it take to reinstate a Maryland LLC?

It takes Maryland’s SDAT about 4-6 weeks to process the Articles or Certificate of Reinstatement. Expedited filings are are processed within 7 business days, and in-person filings are given same-day service when delivered by 4:15 PM.

Can you change your Maryland registered agent on the Maryland reinstatement? <h3>

Yes, you can change your Maryland registered agent on the Articles or Certificate of Reinstatement.

How long do you have to revive a Maryland LLC?

You can revive a business that has been forfeited in Maryland at any time, but your LLC’s name immediately becomes available for other businesses to adopt. If your Maryland LLC was voluntarily dissolved, you’ll have to form a new Maryland LLC.

Maryland Tax Clearance

Some Maryland LLCs need to submit a Maryland tax clearance certificate with the Maryland Articles or Certificate of Reinstatement.

Who needs to obtain a Maryland tax clearance certificate?

All Maryland LLCs must file an annual report, but only some must file the personal property tax return. If your Maryland LLC owns, leases, or uses personal property in Maryland and/or maintains a trader’s license with a local unit of government in Maryland, your LLC must file the personal property tax return.

If your Maryland LLC files a personal property tax return, you’ll need to obtain a tax clearance certificate.

How do you get a tax clearance certificate for a Maryland LLC?

It depends.

- If your Maryland LLC is behind on annual reports, you’ll need to start by preparing the missing annual reports and personal property tax return. You’ll need to submit the personal property tax return to SDAT for assessments. Then, you can contact the city or county where the property is located and pay the personal property tax.

- If your Maryland LLC is caught up on annual reports but has ever reported personal property, you’ll need to request a tax clearance certificate from the county or city where the property is located.

The process for requesting a tax certificate differs by county and city. Even if you have a receipt showing that you paid the tax, you’ll still need to submit a tax clearance certificate.

How long does it take to receive a Maryland tax clearance certificate?

Processing times differ by city/county.

Where can I get help requesting a tax clearance certificate?

You can contact the Maryland Department of Assessments and Taxations business licensing office at (410) 767-1340 or sdat.charterhelp@maryland.gov.