How to Reinstate an Indiana LLC

To revive an Indiana LLC, you’ll need to file the Application for Reinstatement, a current biennial report, and a Certificate of Clearance with the Secretary of State’s Business Services Division. You’ll also have to fix the issues that led to your Indiana LLC’s dissolution. Below, we provide a free, step-by-step guide to reinstating your Indiana LLC.

Revive An Indiana Limited Liability Company

The Indiana Secretary of State has the power to administratively dissolve your LLC if you fail to do any of the following:

- file biennial reports

- appoint and maintain a registered agent

- properly file paperwork to change your registered agent and/or registered office

- pay any fees, penalties, or taxes

To get back into business again, you can apply for reinstatement. To revive or reinstate your Indiana LLC, you’ll have to submit the following to the Indiana Secretary of State:

- an Indiana Certificate of Clearance

- a completed Indiana Application for Reinstatement

- a current Business Entity Report

- a $30 Reinstatement Fee plus any fees for missed reports

- Articles of Amendment of the Articles of Organization (if your name was taken)

Before you can file an Application for Reinstatement, you need to obtain a Certificate of Clearance from the Indiana Department of Revenue. That can take 4 to 7 weeks.

Indiana Tax Clearance Certificate

The Indiana Certificate of Clearance is a document issued by the Indiana Department of Revenue stating that your Indiana LLC is current on all taxes. Applying for one is the first step in reinstating an Indiana LLC.

Applying for a Certificate of Clearance is free, but you won’t receive one unless you’re current on all taxes.

How do I get an Indiana Certificate of Clearance?

To apply to get an Indiana Certificate of Clearance, you need to submit two documents to the Indiana Department of Revenue:

- an Affadavit for Reinstatement (AD-19)

- a Responsible Officer Information Form (ROC-1)

What is an Indiana Affadavit for Reinstatement (AD-19)?

The Application for Reinstatement is a one-page form stating that you are up to date on all taxes. The form makes references to corporations, but it can also be used to reinstate an LLC.

To fill it out, you’ll need to provide your name and role within the business (member or manager). The form also requires your Indiana LLC’s name, date of organization, principal address, FEIN, Indiana Taxpayer Identification Number (TID), the address where records are kept (probably the principal address) and the kind of business your LLC is engaged in.

It’s important that the LLC name listed on this form is identical to the LLC name on your Articles of Organization. Otherwise, your reinstatement will be denied.

Form AD-19 must be signed and notarized.

What is a Responsible Officer Information Form (ROC-1)?

The Responsible Officer Information Form (ROC-1) is the second form required by the Indiana Department of Revenue to get a Certificate of Clearance. The main purpose of the form is to make any changes to your “responsible officers.” For an LLC, this refers to managers or members. Even if you’re not making any changes to your members or managers, you still need to complete the form to obtain your Certificate of Clearance.

The form requires your FEIN, Indiana Taxpayer Identification Number (TID), entity name, DBA name (if needed), and business address.

You’ll also need the names, social security numbers, addresses, and effective dates for old and new members/managers. For each manager and/or member, you’ll need to provide written documentation to prove their role. This may be notes from meetings, financial documentation, or a signed affadavit from another member. For old members/managers, your registration letter will suffice.

The Responsible Officer Information Form must be signed by an existing manager or member.

How long does it take to obtain a Certificate of Clearance?

It takes anywhere between 4-7 weeks to receive your Certificate of Clearance. Shipping your documents overnight or dropping them off may shorten the wait time by a few days.

Where do I submit the AD-19 and ROC-1?

Standard mailing:

Indiana Department of Revenue

Titles & Clearances Division

P.O. Box 6197

Indianapolis, IN

46206

Overnight shipping:

Indiana Department of Revenue

Reinstatements

7811 Milhouse Road, Suite P

Indianapolis, IN 46421

Drop off:

Indiana Department of Revenue

100 North Senate Avenue

Room N-105

Indianapolis, IN 46204

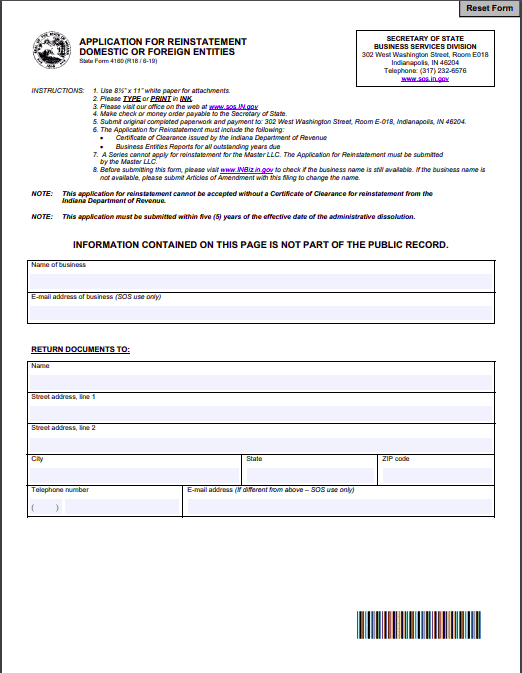

Indiana LLC Reinstatement Application

Once you’ve received your Certificate of Clearance, you can move on to the next steps: filling out the Indiana Application for Reinstatement.

What information do I need for the Indiana Application for Reinstatement?

The Indiana Application for Reinstatement is the form you’ll send to the Indiana Secretary of State to reinstate your LLC.

To fill it out, you’ll need to provide contact information, your LLC’s name, principal address, date of administrative dissolution, the reason the SOS dissolved your LLC, and your registered agent information.

The last section of the form is a statement affirming that your LLC has fixed the problem that led to dissolution and that your LLC’s name is still unique.

How much does reinstatement cost?

The Application for Reinstatement will cost you $30 to file. If your name was taken, you’ll also have to pay the $30 filing fee for a Articles of Amendment.

You only have to file one current biennial report ($50) but you’ll have to pay for all the biennial reports you missed during dissolution. You can call the Information Line to find out your exact total at (317) 232-6576.

How do I file the Indiana Application for Reinstatement?

You can file the Application for Reinstatement online, by mail, or in person. Payment depends on filing method.

- Mail: Check or money order (payable to “Secretary of State”)

- In Person: Check or credit card

- Online: Credit card or e-check

How long does reinstatement take?

Paper filings typically take five days, and online filings are processed within an hour.

How long do I have to revive my Indiana LLC?

You have five years from the date of administrative dissolution to revive a business in Indiana. After that, you’ll have to form a new Indiana LLC.

What if my name was taken?

When your Indiana LLC is administratively dissolved, your name is reserved for 120 days. After that, it becomes available for other companies to adopt.

If your Indiana LLC’s name was taken during administrative dissolution, you’ll need to file an Indiana LLC amendment to change your name. You’ll have to include the amendment and the $30 filing fee with your Application for Reinstatement.

If your name was taken during dissolution, you’ll need to file by mail or in person.

Can I change my Indiana registered agent on the Reinstatement Application?

You can’t change your Indiana registered agent on the Indiana Application for Reinstatement. However, you have to file a current Business Entity Report with your reinstatement application, and you can change your registered agent on that form.

Where do I submit my Indiana Application for Reinstatement?

Reinstatement applications are processed by the Indiana Secretary of State’s Business Services Division. You can submit online, through Indiana’s INBiz system, or to the address below:

Secretary of State

Business Services Division

302 W. Washington St. Rm. E018

Indianapolis, IN 46204