How to Reinstate a Hawaii LLC

To revive a Hawaii LLC, you’ll need to file the Hawaii Application for Reinstatement with the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division (BREG). You’ll also have to fix the issues that led to your Hawaii LLC’s dissolution and obtain a tax clearance certificate from the Hawaii Department of Taxation. Below, we provide a free, step-by-step guide to reinstating your Hawaii LLC.

Revive Or Reinstate A Hawaii Limited Liability Company

The state has the power to administratively dissolve or “terminate” your Hawaii LLC if you fail to do any of the following:

- file annual reports for two years

- appoint or maintain a registered agent

- properly file paperwork for changes to the registered agent or office

- pay any fees required by law

In order to get back into business again, you can apply for reinstatement. To revive or reinstate your Hawaii LLC, you’ll need to submit the following to Hawaii’s BREG:

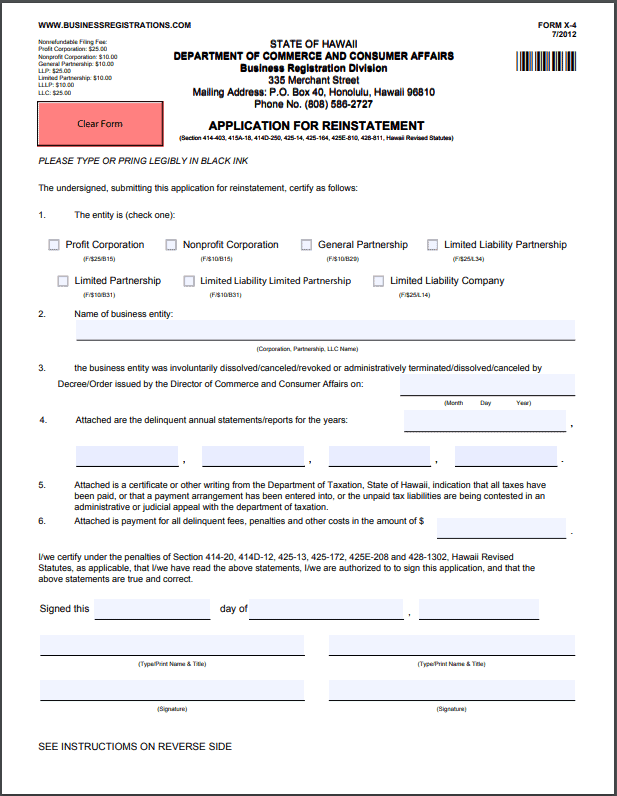

- a completed Hawaii Application for Reinstatement (Form X-4)

- a tax clearance certificate issued by the Hawaii Department of Taxation

- any missing annual reports (including delinquent costs and fees)

- a $25 filing fee

What information do I need for the Hawaii Application for Reinstatement?

To file the Hawaii Application for Reinstatement, you’ll first need to select your entity type (LLC). You’ll then list your LLC name, the date your LLC was dissolved, and the amount of delinquent fees and penalties you’re including payment for.

Your tax clearance certificate and any late annual reports must be attached to your application. The form must also be signed by at least one member (or one manager if your LLC is manager-managed).

How do I file the Hawaii Application for Reinstatement?

You can submit the Hawaii Application for Reinstatement to BREG by mail, in person, or by fax. Payment options depend on how you plan to file:

- Mail: Check (payable to “Department of Commerce and Consumer Affairs”)

- Fax: Credit card (documents must specify regular or expedited review, the total payment amount, and the sender’s credit card and contact information)

- In Person: Check or credit card

Where do I submit my Hawaii Application for Reinstatement?

Reinstatement applications are processed by the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division.

Mailed Filings:

PO Box 40

Honolulu, HI 96810

Faxed Filings:

(808) 586-2733

In-Person Filings:

King Kalakaua Building

335 Merchant Street, Rm 201

Honolulu, HI 96813

How much will it cost to revive a Hawaii LLC?

The filing fee for an Application for Reinstatement is $25. The filing may be expedited for an additional $25 fee.

How long does it take the state to process the Hawaii Application for Reinstatement?

It takes Hawaii’s BREG about five business days to process the Application for Reinstatement (1-3 days expedited). If you include the time to get the tax clearance certificate (see below), the total process to reinstate your Hawaii LLC can take up to 20-30 business days.

Can you change your Hawaii registered agent on the Hawaii reinstatement?

The Hawaii Application for Reinstatement does not give you the option of changing your registered agent at the time of reinstatement. You can change your Hawaii registered agent by completing and filing Form X-7 Statement of Change of Registered Agent by Entity with Hawaii’s BREG or in your annual report.

However, if your Application for Reinstatement includes your most current annual report, you can use this report to update changes to your registered agent, as well as changes to your principal address or members or managers.

How long do you have to revive a Hawaii LLC?

You can revive a business within two years after the date of dissolution. After that time, you’ll have to form a new Hawaii LLC.

Hawaii Tax Clearance

Before you can submit your Hawaii Application for Reinstatement, you’ll need to obtain a letter from the Department of Taxation clearing your business of tax liability. If you’re behind on taxes, this means you’ll need to first submit any past filings or payments (or arrange a payment plan).

Not sure if your business is current with Hawaii tax requirements? Contact the Department of Taxation at (808) 587-4242 or email Taxpayer.Services@hawaii.gov.

How do you get a tax clearance letter for a Hawaii LLC?

To get a tax clearance certificate from the Hawaii Department of Taxation, you’ll need to submit a Tax Clearance Application (Form A-6). You can download the application from the Department of Taxation website or file electronically with Hawaii Tax Online. There’s no fee to submit the application.

At minimum, you’ll be required to provide contact and identification information (such as your Hawaii Tax ID and EIN) and the signature of an authorized person, such as a member or manager. You’ll also need to note why the tax clearance is required. There are additional questions for certain businesses, such as tax-exempt nonprofits and businesses without a GET license.

How long does it take to receive Hawaii tax clearance?

If you file your tax clearance application by mail, by fax, or online, it usually takes 10-15 business days to process. A tax clearance application walked in to any district tax office can often be processed the same business day.

Where do I file my Hawaii tax clearance application?

Paper applications can be submitted by mail, fax or in person:

Mailed Filings:

State Dept. of Taxation

Taxpayer Services Branch

PO BOX 259

Honolulu, HI 96809-0259

Faxed Filings:

808-587-1488

In-Person Filings:

Oahu District Office

Princess Ruth Keelikolani Building

830 Punchbowl Street

Honolulu, HI 96813-5094

Maui District Office

State Office Building

54 S High Street, #208

Wailuku, HI 96793-2198

Hawaii District Office

State Office Building

75 Aupuni Street, #101

Hilo, HI 96720-4245

Kauai District Office

State Office Building

3060 Eiwa Street, #105

Lihue, HI 96776-1889