How Credit Card Processing Works

The Credit Card Payment Process Simplified

You don’t need insider knowledge of how credit card processing works to accept credit card payments at your business. Most people don’t bother. They accept whatever sales jargon their agent throws at them, get signed up with a payment processor, and start taking payments.

But understanding how the credit card payment process works is the sort of eccentric talent that separates the business with leverage from the business without it. So let’s check it out.

Credit Card Processing:

What You'll Discover Below

Payment Processing 101

The ability to accept credit card payments is a must in today’s business environment. Understanding how credit card processing works can help you offset fees and anticipate when your business will get paid.

Want to know more about payment processing as a business owner? Click the button below to access our paymentprocessing guide.

What is Credit Card Processing?

Credit card processing is a service that allows merchants to accept credit and debit card payments. The service is provided mainly by companies called credit card processors (or payment processors), which securely transmit transaction information from your payment portal to banks and card networks like Visa and MasterCard. This includes in-person payments through traditional payment terminals and online payments through a payment gateway.

When you accept credit card payments at your business, your payment processor is essentially your connection to the rest of the card payment industry, as well as the final arbiter in determining your overall processing costs.

What Is the Credit Card Payment Process?

The credit card payment process is the sequence of events that takes place between when you swipe, dip, or key-in a card transaction for one of your customers and when the funds for that payment get deposited in your business’s bank account.

The credit card payment process involves an array of interactions between several players—banks, payment processors, card brands, and of course your customer and you. These interactions are also the source of the various credit card processing fees you’ll pay—all of which are essentially service fees derived from the role each business plays.

Credit card processing takes place in two broad stages:

- authentication and authorization, and

- clearing and settlement.

To better understand how payment processing works, we’ll start by naming and defining the key players involved. Then we’ll explore the details of each stage in the credit card payment process.

Credit Card Processing: the Key Players

- Cardholders are the individuals or businesses who make a payment using a credit card.

- Issuing banks are the banks that issue credit cards to consumers.

- Merchants are businesses that accept credit cards as payment.

- Payment processors are the companies that process credit card and debit card payments for merchants. Your payment processor is your business’s connection to the acquiring banks and card associations.

- Acquiring banks are the banks that provide merchant accounts for processing payments. Also known as merchant acquirers or merchant banks.

- Credit Card Networks determine interchange rates and the rules businesses must follow to accept their branded cards as payment. Also known as card associations, card brands, and card schemes, these include Visa, MasterCard, American Express, and Discover.

Note that we’ll focus on the basic, in-person credit card payment in the descriptions throughout this page. If you’re accepting credit card payments online, additional providers might play a role (such as a payment gateway service provider). Check out our Ways to Accept Credit Card Payments page to learn more.

Authentication & Authorization

The first stage in the credit card payment process (authentication and authorization) is the familiar one: it’s where your customer presents a credit card as payment, you submit the transaction and card details through your payment portal, and the payment request comes back as either approved or declined.

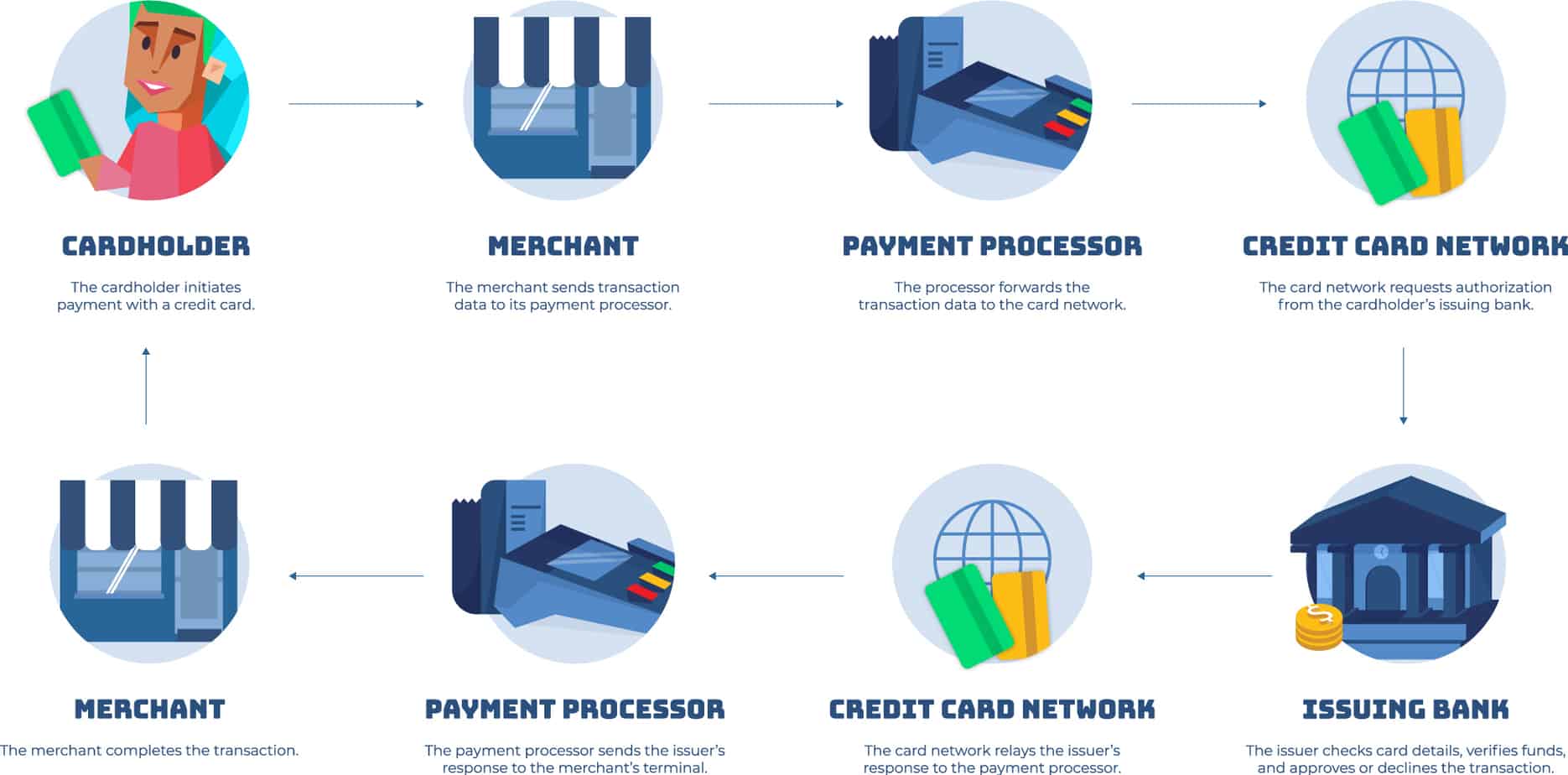

The cardholder (the customer) presents a credit card to the merchant as payment. This can happen in-person, online through a website, or over the phone.

The merchant’s terminal or payment portal sends the transaction information to the merchant’s payment processor. This is an authorization request that will eventually reach the cardholder’s issuing bank.

The merchant’s payment processor receives the transaction information and authorization request from the merchant and forwards it to the appropriate credit card network based on the brand of credit card the cardholder used (MasterCard, Visa, Discover or American Express).

The card brand or card network receives the authorization request from the payment processor. If the card brand is the same as the card issuer (as with American Express), the payment is authorized or declined directly. For card networks like Visa and MasterCard, the authorization request is sent to the cardholder’s issuing bank instead.

The cardholder’s issuing bank verifies the card information and approves or declines the transaction. If approved, the issuing bank places a hold for the transaction amount on the cardholder’s account. In the case of Visa and MasterCard, the issuing bank sends its response back to the credit card network.

The credit card network relays the issuing bank’s response (approved or declined) to the merchant’s payment processor.

The payment processor sends the issuing bank’s response to the merchant’s payment terminal or payment portal.

Clearing and Settlement

The second stage in the credit card payment process (clearing and settlement) covers the ground from when you submit a batch of authorized transactions to the point where the funds for those payments get deposited in your business’s bank account.

The merchant sends a “batch close” of authorized payment requests to the merchant’s payment processor (usually at the close of the business day). This can happen manually or automatically depending on the processing tools the merchant uses.

The merchant’s payment processor sorts the authorized transactions and sends the transaction information to the appropriate credit card networks or card brands (Visa, MasterCard, Discover, and American Express, as the case may be).

In the cases of American Express and Discover (both issuing banks), the card brand clears and settles the authorizations directly. For card networks like Visa and MasterCard, the network sends the authorizations to the banks that issued the cardholders’ credit cards.

The issuing bank charges the cardholder’s account, subtracts its service fees for the transaction (called interchange fees), and sends what remains from the payment to the merchant’s payment processor.

The merchant’s payment processor sends the funds from the payment to the merchant’s acquiring bank (if different from the processor). Depending on your processor and the terms of your merchant agreement, the processor might subtract its fees once a month or in advance of depositing the money in your account.

Note, however, that even the funds from cleared and settled credit card payments aren’t automatically free and clear. Your customers have the ability to dispute payments (called chargebacks) after the initial sale for a period of time set by each card brand. To learn more, check out our page on credit card chargebacks.

Credit Card Processing FAQs

1-3 days is a good ballpark figure for when the funds from a payment will get deposited in your business’s bank account, but most payment processors offer same-day or next-day funding options if you’re willing to pay an additional monthly fee. In any case, you can expect to get your money fast.

No. Neither Visa nor MasterCard issue credit cards or debit cards directly to consumers. They are both card networks in the strict sense that they work with and help regulate issuing banks provide consumers with their branded cards.

Yes. Both Discover and American Express issue credit cards directly to consumers, though in recent years both companies have started working with other issuing banks as well (somewhat like Visa and MasterCard).

When it comes to online credit card processing, most of the credit card payment process is the same and involves the same key players, but you’ll process payments through a payment gateway instead of physical payment terminal. The gateway will communicate card and transaction information from your website to your payment processor.

Your overall processing costs will be set by your business’s payment processor, but those costs will include interchange fees paid to card issuing banks and card brand fees paid to the card networks for transactions processed with their branded cards (Visa, MasterCard, Discover and American Express). Learning how to calculate your credit card effective rate is a simple yet powerful tool for comparing payment processors to be sure your processor isn’t piling excessive markups on top of your processing fees.

You cannot avoid paying credit card processing fees, but there are some ways to offset the costs. We encourage most merchants to choose interchange plus pricing plans since they tend to be more cost-effective and offer you more transparent insights into your business’s monthly processing fees. Additionally, some business owners use cash discounts or credit card surcharges to pass on the cost of accepting credit card payments to customers.

Yes, although there are several types of companies that commonly get called “payment processors.” These include the true back-end processors like TSYS and Worldpay, payment service providers (PSPs) like Square and Stripe, and a host of companies called independent sales organizations (ISOs) that resell payment processing services under their brands. Some big banks also provide payment processing services of their own.

No, or at least not always. In general, payment processors are companies that support the technical side of the credit card payment process for merchants, and acquiring banks provide and fund merchant accounts. However, some acquiring banks also provide payment processing services, so the processor and the acquiring bank can be one and the same.

You can sign up directly with a payment service provider (PSP), ISO, or a payment processor, or you can work with a sales agent to get signed up (and sometimes, in the process, save on credit card processing fees and other service fees).