How To Start A Nonprofit In Kansas

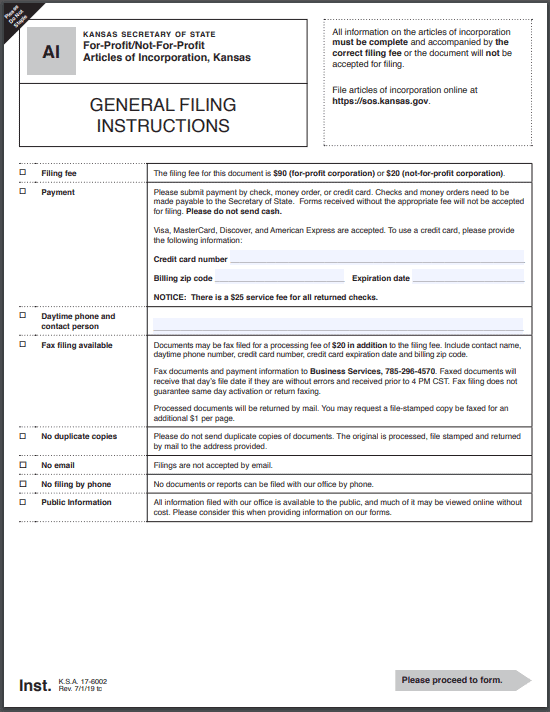

To start a nonprofit corporation in Kansas, you must file the Not-For-Profit Articles of Incorporation with the Kansas Secretary of State. You can submit your nonprofit’s articles of incorporation online, by fax, or by mail. The articles of incorporation cost $20 to file. Once filed with the state, your articles of incorporation officially create your Kansas nonprofit corporation, but truly preparing a nonprofit to pursue its mission involves several additional steps.

Starting a Kansas Nonprofit Guide:

- Choose your Kansas nonprofit filing option

- File the KS nonprofit articles of incorporation

- Get a Federal EIN from the IRS

- Adopt your KS nonprofit's bylaws

- Apply for federal and/or state tax exemptions

- Apply for any required business licenses

- Open a bank account for your KS nonprofit

- Submit your KS nonprofit Biennial report

Kansas Nonprofit Filing Options

Free PDF Download

Download the Kansas Not-For-Profit Articles of Incorporation. Fill out the form and submit to the state.

Do It Yourself Online

Our free account and tools will walk you through starting and maintaining a Kansas nonprofit. All for free.

$39 + State Fees

Our nonprofit formation service includes free year of registered agent, bylaws, website, domain & more.

KS Not-For-Profit Articles of Incorporation Requirements

To incorporate a Kansas nonprofit, you must complete and file the Not-For-Profit Articles of Incorporation with the Kansas Secretary of State. See the document below and click on any number to see what information is required in the corresponding section.

How Much Does It Cost To Incorporate A Kansas Nonprofit?

Kansas charges $20 to file nonprofit Articles of Incorporation by mail or online, and you can pay an additional $20 fee to fax your articles to the Kansas Secretary of State.

How Long Does It Take To Start A Kansas Nonprofit?

Submit your articles yourself online, and you’ll get a near immediate response from the state. If you mail your articles to the Kansas Secretary of State, however, you should expect a 2-3 day processing time.

Does a Kansas Nonprofit Need a Registered Agent?

Yes, your nonprofit Articles of Incorporation require the name and address of a Kansas resident agent (called a “registered agent” in most states). Your resident agent can be individual (such as yourself or an associate) or a business entity authorized to accept service of process (legal notices) on your behalf. The address listed must be a physical street address in Kansas, and your resident agent must be available at this address during normal business hours.

You can do the job yourself, but we don’t recommend it. Your nonprofit’s Articles of Incorporation are public documents, so the address of your nonprofit’s registered office is also public. If you list your personal address or your office address, you’ll have to put up with a lot of junk mail and unwanted solicitors, and you might even fall prey to data-sellers.

Northwest offers an effective solution. Hire us, we’ll scan and send you any services of process on the day we receive them. Our service will free you up to focus on what matters most: managing and growing your new nonprofit.

Get a Federal EIN from the IRS

Do I Need A Federal Tax ID Number (EIN) For My Kansas Nonprofit?

Kansas will expect you to get a federal employer identification number (EIN) for your nonprofit. You’ll need an EIN to apply for federal and state tax exemptions, to open a bank account in your nonprofit’s name, and for pretty much every other significant financial matter that faces your nonprofit. You can sign up for an EIN online with the IRS, or you can add our EIN service for an additional fee when you hire Northwest.

Hold Your Organizational Meeting & Adopt Bylaws

Does A Kansas Nonprofit Need Bylaws?

Kansas requires a nonprofit to adopt bylaws at its organizational meeting. This is a nonprofit’s first official meeting, held shortly after the state approves its Articles of Incorporation, where it completes the formation process by electing officers, approving bylaws, deciding how to compensate employees, and doing whatever else is necessary to begin its day to day operations. Your nonprofit should adopt its bylaws prior to applying to the IRS for 501(c)(3) tax-exempt status.

Why Do Bylaws Matter?

You won’t submit your nonprofit’s bylaws to the state, but that doesn’t mean they don’t matter. Without bylaws your directors and officers can’t make consistent decisions, and the nonprofit can’t unite behind a single path and a single vision. How long should a director stay in office? Do all members have the right to vote to elect directors? How can the organization remove a director? (And so on!) Questions like these need clear answers up front, and your nonprofit’s bylaws exist to provide these answers.

Hire Northwest, and you can use our adaptable template for writing nonprofit bylaws. You’ll also gain access to numerous other free forms to help guide your nonprofit’s early days. What’s in it for us? We want your organization to start strong, stay strong, and come back year after year to renew your registered agent service with Northwest. Your success, after all, is our success.

Apply for Federal and/or State Tax Exemptions

Will My Kansas Nonprofit Be Tax-Exempt?

Not automatically. The IRS grants or denies nonprofits tax-exempt status, so you’ll need to file an Application for Recognition of Exemption with the IRS (either Form 1023, 1023-EZ, or 1024). This form includes information about your nonprofit’s purpose, organization, and finances, and the IRS uses it to determine if your nonprofit qualifies as an exempt organization. There are currently more than two dozen types of exempt nonprofits recognized by the IRS, but most nonprofits seek 501(c)(3) tax-exempt status for public charities and private foundations. If your nonprofit intends to become a 501(c)(3) organization, your Articles of Incorporation should should include a statement of purpose and dissolution of assets provision using the specific language required by the IRS.

If your nonprofit qualifies for federal tax-exempt status, it will also be exempt from the Kansas state income tax. However, nonprofits must apply to the Kansas Department of Revenue to obtain an exemption from the sales and use tax (and keep in mind that not all 501(c)(3) organizations qualify). Visit Northwest’s Kansas state tax exemptions guide to learn more.

Obtain Kansas State Business Licenses

Does A Kansas Nonprofit Need A Business License?

Kansas doesn’t issue a statewide business license, but specific cities and counties may have their own licensing requirements. Contact your local officials (including your city clerk’s office) to learn what ordinances and permits apply to your nonprofit.

Will My Kansas Nonprofit Need To Register For State Tax Accounts?

Yes, your new nonprofit will need to submit a Kansas Business Tax Application (Form CR-16) to the KS Department of Revenue. This form provides information to the Department of Revenue about your nonprofit and allows you to register for those tax accounts relevant to your nonprofit’s activities (such as the withholding tax if you’re going to hire and pay employees).

You can register online at the Department of Revenue’s website or print and mail your application to the Kansas Department of Revenue / PO Box 758573 / Topeka, KS 66675-8573.

Do I Have To Register My Nonprofit As A Charity In Kansas?

If your nonprofit solicits donations for charitable purposes, you should register as a Kansas charity with the Secretary of State. You can register online at the Secretary of State’s website or mail a printed application to Memorial Hall, 1st Floor / 120 S.W. 10th Avenue / Topeka, KS 66612-1594.

There is a $35 filing fee, and you’ll also pay $35 each year to renew your registration with the state. Learn more at Northwest’s guide to Kansas charity registration.

Open a Bank Account for Your Kansas Nonprofit

To open a bank account for your Kansas nonprofit, you will need to bring the following items with you to the bank:

- A copy of your Kansas nonprofit’s articles of incorporation

- A copy of your nonprofit’s bylaws

- Your Kansas nonprofit’s EIN

It’s wise to call your ahead of time to check its requirements. Some banks may require you to bring a resolution authorizing you to open a bank account in your nonprofit’s name (particularly if your nonprofit has several directors and/or officers).

Submit Your KS Nonprofit Biennial Report

What Is The Kansas Nonprofit Biennial Report?

Kansas requires pretty much every type of business (corporations, LLCs, partnerships, and nonprofits) to file a biennial report every other year. If you formed your nonprofit in an even year, your report will be due every succeeding even year. Same goes for nonprofits formed in odd years.

For nonprofits there is a $80 fee, and the form updates your nonprofit’s membership and contact information. The deadline is always the 15th day of the sixth month following your tax closing month (if your tax closing month is December, for example, the deadline is June 15th). You can file by mail or at the Kansas Electronic Report Filing System.

But if you’d rather not bother keeping up with these fees and deadlines, you’re in luck. When you hire Northwest, you can also sign up for our convenient Kansas Biennial Report Service for an additional fee.