How to Start a Series LLC in Virginia

To form a Virginia Series LLC, you must file Articles of Organization with the Virginia State Corporation Commission (SCC) and pay a $100 filing fee. You can submit this document online, by mail, or in person. Filing Articles of Organization forms your master LLC. But, creating your Series LLC and getting ready to conduct business requires taking additional steps. Our Virginia Series LLC guide will help you get started.

Virginia Series LLC Guide:

- Understand the Virginia Series LLC

- Submit the Virginia Articles of Organization

- File Statements of Protected Series

- File or Update BOI Report

- Create a Virginia LLC Operating Agreement

- Get Federal EINs from the IRS

- Open bank accounts for your VA Series LLC

- Obtain any required business licenses

- Pay Virginia Annual Registration Fees

What is a Virginia Series LLC?

A Virginia Series LLC is a type of Limited Liability Company comprised of a master LLC and one or more divisions (called “series”) within it. When properly maintained, each series has its own limited liability and can sue or be sued, enter into contracts, pursue its own business purpose, and keep separate financial records. This means that if one series is sued, the other series (and the master LLC) are typically not held liable.

The Virginia Series LLC structure is often utilized by holding companies to create protective barriers between assets such as real estate or intellectual property. However, a Series LLC can serve other purposes as well.

Series LLC is offered in more than a dozen states. To learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC, see our Series LLC Guide.

Virginia Articles of Organization Requirements

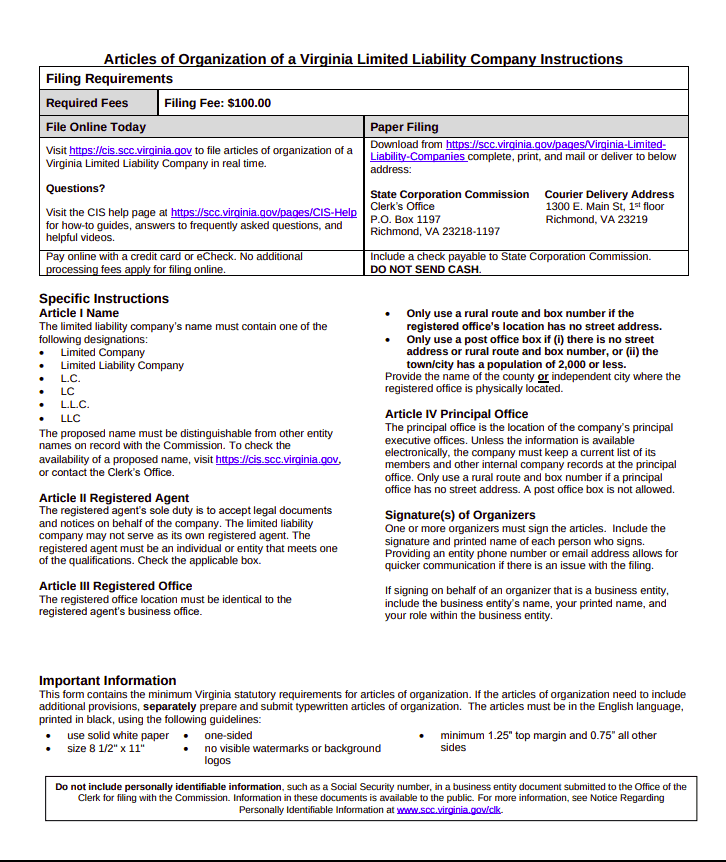

To form a Virginia Series LLC, you must file Articles of Organization with the Virginia State Corporation Commission. You can submit this document online, by mail, or in person.

Below, we provide detailed instructions for filing and a complete list of information you’ll need to include. You’ll also find a link to download the Virginia Articles of Organization.

How much does it cost to form a Virginia Series LLC?

To file Virginia Articles of Organization, you’ll need to pay a $100 filing fee. You may file online, by mail, or in person. Online submissions must be paid with a credit card. Mailed and in-person filings must be paid with a check made payable to “State Corporation Commission.”

Keep in mind that each series within your Virginia Series LLC will be required to pay a $50 annual registration fee. So, if you create five series, you’ll end up paying $250 in annual registration fees for your series and another $50 for your master LLC.

How long does it take to form a Virginia Series LLC?

Online submissions are processed within 24 hours of receipt. Paper filings will take 5-7 business days to process after they’re received.

Does a Virginia Series LLC need a registered agent?

Yes. Per VA Code § 13.1-1097, your Virginia Series LLC must appoint a registered agent to accept legal documents on its behalf. Your registered agent should have a physical address in Virginia. However, you may list a rural route and box number if your registered agent doesn’t have a street address. PO Boxes are only allowed if there’s no street or rural route address available.

Does each series of a Virginia Series LLC require its own registered agent?

No. Your Virginia registered agent will serve all series—including the master LLC.

Virginia Statement of Protected Series Designation Requirements

Filing Articles of Organization officially forms your master LLC, but to form a series, you must file a Statement of Protect Series Designation with the Virginia State Corporation Commission. You can submit the statement online, by mail, or in person. There is a $100 filing fee. You must file a separate statement ( and pay a separate filing fee) for each series you wish to form.

You will need to include the following information:

- The name of your Master LLC (from your Articles of Organization)

- The name of the series you wish to form, which must begin with the name of the Master LLC and include “protected series,” “P.S.” or “PS.” So, if your Master LLC is Levi’s Llama Farm LLC, then your series may be Levi’s Llama Farm LLC, West Valley, Protected Series.

- The principal address of the series. This should be a street address. However, you may use a rural route if there’s no physical address. PO Boxes are not allowed.

- The signature and printed name of the person authorized to file the statement.

How do I amend or dissolve one of my series?

To amend one of your series, you’ll file a Statement of Designation Change of a Virginia Protected Series. To dissolve a series, you’ll need to file a Statement of Designation Cancellation of a Virginia Protected Series. Both forms have a $25 filing fee and can be submitted online, by mail, or in person. You must file a separate statement of change or cancellation for each series you wish to update or dissolve.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Virginia Series LLC Operating Agreement

Your Virginia Series LLC’s operating agreement will outline your company’s management structure and operating procedures. In addition, it should define how your Series LLC will handle any future challenges. Along with your Articles of Organization and Statement of Protected Series Designation, your Virginia Series LLC operating agreement will authorize your business to form, amend, and dissolve the series.

Do I have to write the Operating Agreement?

Because the Virginia Series LLC business structure is complex, we recommend seeking professional help from an attorney. But, that doesn’t mean you have to start with a blank page. At Northwest, we provide free templates for creating an operating agreement and other business-related documents. You can use our templates as a starting point for crafting your LLC’s operating agreement and other important documents.

Here are just a few of the LLC forms available from Northwest Registered Agent:

Get Federal EINs from the IRS

Does a Virginia Series LLC need an EIN?

Yes. If you wish to hire employees, open bank accounts, or take advantage of the S corporation tax selection, you’ll need to obtain an employer identification number (EIN) from the IRS. Fortunately, you can apply for an EIN through the IRS website. It’s simple and free.

Should I get a separate EIN for each series of my Virginia Series LLC?

Yes. Each of your Virginia protected series will need its own EIN to hire employees and open its own bank account. Maintaining individual financial records is crucial for preserving the limited liability of each series.

Open Bank Accounts For Your Virginia Series LLC

At minimum, you’ll need to provide your local bank with the following information to open a bank account:

- A copy of your Articles of Organization

- Your Virginia Series LLC operating agreement

- Your Federal EIN (employer identification number)

If your Virginia Series LLC has multiple members, you may also provide a resolution stating you or the persons opening the bank account have permission from the other members/managers.

Obtain any Required Business License

Virginia doesn’t require a state business license to conduct business within the state. However, some cities and counties in Virginia require local business licenses—check your local county and city websites for business licensing requirements. Some professions (including real estate agents, engineers, and contractors) will need to apply for a license through the Virginia Department of Professional and Occupational Regulation (DPOR) website.

The cost of a business license will vary; however, you’ll probably pay somewhere between $50 and $200.

Pay Virginia Annual Registration Fees

Virginia requires all LLCs to pay an annual registration fee of $50. Your payment will be due by the last day of your anniversary month. So, if you formed a business on April 25, 2021, then your renewal fee will be due by April 30 each year.

You can pay your registration fee online, by mail, or in person. Online payments must be paid with a credit card. Mailed payments can be paid with a check or money order made payable to “State Corporation Commission.” In-person payments can be paid with a credit card, check/money order, or cash.

Learn more at Northwest’s guide to the Virginia Annual Report.

Does each series need to pay an Annual Registration Fee?

Yes. Each series (including the master LLC) is required to pay a separate registration fees each year. So, if your Virginia Series LLC has four series, you would pay $200 each year, plus another $50 for your master LLC.

Let Us Be Your Guide

Interested in starting a traditional Virginia LLC instead of a Series LLC? Northwest had you covered. At Northwest Registered Agent, we’ve spent years crafting our Virginia LLC service. When you hire us, we’ll form your Virginia LLC for $328 total and include:

• One year of registered agent service

• An LLC operating agreement, membership certificates, and LLC resolutions

• Digital notifications

• A secure online account filled with intuitive business maintenance tools and forms to make LLC upkeep simple

• Lifetime Corporate Guide Service—call us anytime, and one of our Corporate Guides will help you navigate whatever business problem, task, or curiosity you have

Northwest Registered Agent is the only national LLC formation service that is dedicated to your personal privacy. We don’t sell data to third parties, and we do everything we can to keep your personal information secure.