How to Start a Series LLC in Utah

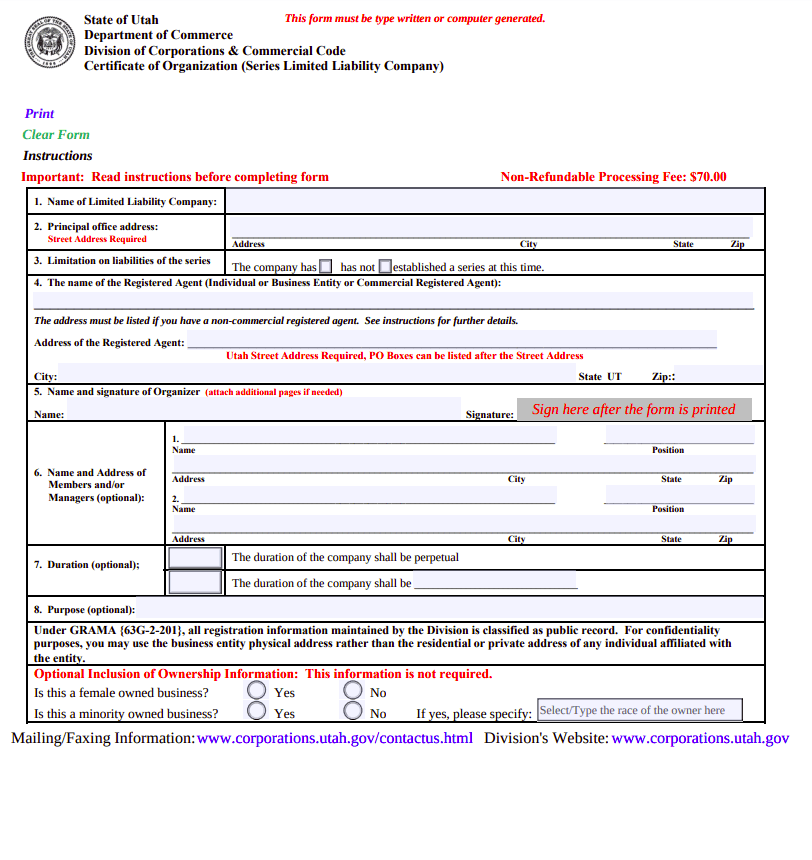

To create a Utah Series LLC, you’ll need to file a Certificate of Organization (Series Limited Liability Company) with the Utah Department of Commerce, Division of Corporations & Commercial Code. You may submit the Certificate of Organization online, by mail, fax, or in person. Regardless of how you file, your form will need to be typed. There is a $70 filing fee. Our Utah Series LLC guide will help you form your new company and prepare it to conduct business.

What is a Utah Series LLC

A Utah Series LLC is a particular type of Limited Liability Company that can create divisions (or series) within itself. Each series has its own limited liability, which means that the series are not typically held responsible for the debts of another series (or the parent LLC). Each series can hold its own assets, have separate financial records, and pursue different business purposes. They can also enter into contracts, sue and be sued, and grant liens without affecting the other LLCs within the series.

Series LLCs are offered in more than a dozen states. To learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC, see our Series LLC Guide.

Utah Certificate of Organization Requirements

Establishing a Utah Series LLC requires filing a Certificate of Organization (Series Limited Liability Company) with the Utah Department of Commerce, Division of Corporations and Commercial Code.

Here’s a complete guide for how to file. You’ll also find a link to download the Certificate of Organization for a Utah Series LLC.

How much does it cost to form a Utah Series LLC?

The Utah Department of Commerce, Division of Corporations and Commercial Code charges $70 for standard processing (7-10 business days after receipt). You can pay an additional $75 ($145 total) to have your form processed within two business days after it’s received.

Online and faxed submissions must be paid with a credit card. Mailed and in-person filings can be paid with a check (made payable to “State of Utah”) or a credit card. All credit card payments must include a payment cover letter.

Keep in mind that you’ll have to file a separate annual report (and pay the filing fee) for each series in your LLC. It costs $20 to file the annual report, so if you have 10 series, you’ll be looking at paying $200 a year in annual report fees.

Does a Utah Series LLC need a registered agent?

Yes. Per UT Code § 48-3a-111 (2019), a Utah Series LLC is required to appoint a registered agent. Your Utah registered agent must have a physical street address in Utah and be available during regular business hours to accept legal mail on behalf of your Series LLC.

Does each series of a Utah Series LLC require its own registered agent?

No. Your appointed Utah registered agent will serve as the registered agent for all series—including the parent LLC.

How do I add or remove series from my Utah Series LLC?

To add or remove series from your Utah Series LLC, you must update your LLC operating agreement. You can also note these changes online through the Utah Department of Commerce website. If you choose to update online, you’ll need your Utah entity number and access ID. There is no fee to add series.

Don’t have your Utah entity number or access ID? Contact the Department of Commerce office.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Create a Utah Series LLC Operating Agreement

A Utah Series LLC Operating Agreement outlines who owns the company, the management structure, and the members associated with each series. You should also include provisions for how your Series LLC will handle potential challenges or dissolution.

Amending your Utah Series LLC operating agreement is also how your business establishes individual series. Utah doesn’t require LLCs to have an operating agreement, but without one a judge may not uphold your series’ liability protection.

How do I write a Utah Series LLC Operating Agreement?

Because your operating agreement will serve as a legal document, we strongly suggest seeking help from a professional attorney. However, this doesn’t mean you have to start from scratch. At Northwest, we provide our customers with a template for creating an LLC operating agreement. You may customize the template to fit your specific needs. Check out this free template and others below:

Get Federal EINs from the IRS

Does my Utah Series LLC need a Federal EIN?

Yes. Having a Federal EIN (Employer Identification Number) will allow your Utah Series LLC to hire employees, file taxes, and open individual bank accounts. You’ll also need an EIN if you choose to file taxes as an S Corporation.

To obtain an EIN, you can visit the IRS website and submit an application. There is no fee.

Do I need Separate EINs for Each Series in my Utah Series LLC?

Most likely, yes. Each series within your Utah Series LLC will need its own bank account in order to maintain separate financial records, which is crucial for maintaining the limited liability of each series. And you’ll need a separate EIN to open each bank account.

Open Bank Accounts For Your Utah Series LLC

Opening a bank account will require (at minimum) providing your bank with the following:

- Copy of your Certificate of Organization

- Your Series LLC operating agreement

- Your Federal EIN (Employer Identification Number)

If your company has multiple members, you may also include a resolution stating you or the persons opening the account have permission to do so from the other members.

Obtain any Required Business License

Does a Utah Series LLC require a business license?

Yes. You will need to obtain a business license from the county or city where your Series LLC is located. Filing fees will vary among locations, but you will likely pay between $22 and $52.

To obtain a business license, you can call your local municipality’s office or visit their website.

File Utah Annual Reports

What is a Utah Annual Report?

Each year, your Series LLC will be required to file an annual report with the Utah Department of Commerce, Division of Corporations & Commercial Code. The purpose of the annual report is to renew your business name, so you’ll only need to provide the following information:

- Your Utah entity number. To find your entity number, you can search the Utah business database.

- Business type

- Date your annual report is due

- Name of your company

That’s it! Your due date will be your LLC’s formation anniversary date. For example, if you formed a business on April 25, 2020, your annual report will be due each year on April 25th.

Learn more at Northwest’s guide to the Utah Annual Report.

Does each series need to file a Utah Annual Report?

Yes. Each series (including the parent LLC) is required to file a separate Utah Annual Report. You may file online or by mail. The filing fee is $20 for each report you file.

Let Us Be Your Guide

Interested in forming a traditional Utah LLC instead of a Series LLC? At Northwest Registered Agent, we’ve spent years crafting our Utah LLC service. When you hire us, we’ll form your Utah LLC for $325 total and include:

- One year of registered agent service

- An LLC operating agreement, membership certificates and LLC resolutions

- Digital notifications

- Utah Annual Report reminders and directions for fast filing

- A secure online account filled with intuitive business maintenance tools and forms to make LLC upkeep simple

- Lifetime Corporate Guide Service—call us anytime and one of our Corporate Guides will help you navigate whatever business problem, task or curiosity you have

Northwest Registered Agent is the only national LLC formation service that is dedicated to your personal privacy. We don’t sell data to third-parties and we do everything we can to keep your personal information secure.