How to Start a South Dakota Series LLC

To form a South Dakota Series LLC, you will first need to file your Articles of Organization with the Secretary of State. Be aware that filing articles for a Series LLC requires a different document from a traditional LLC, and is a little more costly ($200 versus $150). However, creating a Series LLC may save you more money over time.

Once you file your articles you will have created your Series LLC, but there are some additional steps to take before you can start conducting business and creating your individual series.

South Dakota Series LLC Guide:

- Understand the South Dakota Series LLC

- Submit SD Series LLC Articles of Organization

- Submit SD Certificate of Designation

- File or Update BOI Report

- Create an SD Series LLC Operating Agreement

- Get Federal EINs from the IRS

- Open bank accounts for your Series LLC

- Obtain any required business licenses

- File the SD Series LLC Annual Report

What is a South Dakota Series LLC?

A South Dakota Series LLC is a business structure that allows for a limited liability company (or “parent LLC”) to branch out into smaller LLCs, called series (or “child LLCs”). This structure not only protects the parent LLC from liability, it protects the assets within each child LLC from each other as well. In other words, a Series LLC is a collection of companies all organized under the initial creation of one LLC—which can ultimately save businesses money over time.

To learn more about Series LLCs and which states recognize them, see our Series LLC Guide.

South Dakota Series LLC Articles of Organization Requirements

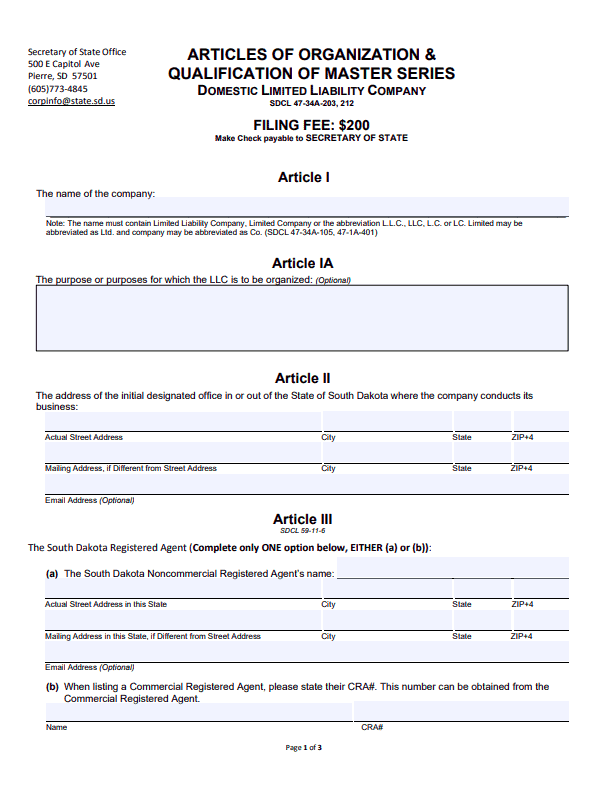

To form a South Dakota Series LLC, you must first submit your Articles of Organization & Qualification of Master Series to the South Dakota Secretary of State’s office. You will also need to submit a Certificate of Designation for each series, which you can read more about in Section 3. See the document below to look through South Dakota’s Articles of Organization, or click on any number to read more about each step in the process.

When filling our your articles, you’ll be asked whether you’re using a noncommercial registered agent, or a commercial registered agent (e.g. Northwest Registered Agent). If using a commercial agent, you will need to include a CRA#, which you can get from your agent.

If your company will be manager-manged, you’ll need to list the names and addresses of all initial managers.

How much does it cost to register a South Dakota Series LLC?

It costs $200 to file Articles of Organization for a South Dakota Series LLC, and $50 for each additional series.

How long does it take to register a South Dakota Series LLC?

Though you may file your annual reports online, online filing is not yet available for filing Articles of Organization for a South Dakota Series LLC. Mail filings typically take 3-5 business days to process after the state receives them.

Does a South Dakota Series LLC need a registered agent?

Yes. All South Dakota LLCs are required to have a South Dakota registered agent to accept important documents and legal notices from the state on behalf of the business. Your registered agent must be available during normal business hours and have a physical address (not a P.O. Box) in South Dakota.

Does each series of a South Dakota Series LLC need its own registered agent?

Nope! Within a Series LLC, each series must use the same registered agent listed in the Articles of Organization filed by the parent LLC.

South Dakota Certificate of Designation Requirements

After you file your Articles of Organization, you’ll need to file a Certificate of Designation for each series in your South Dakota Series LLC. Since your articles already include information that pertains to both your parent LLC and each child LLC (i.e. resident agent info), filling out the Certificate of Designation is pretty simple.

Each individual series name must include the full name of the parent LLC and a word or phrase that distinguishes each series from one another. For example, if your parent LLC is called Dakota Series LLC, one series might be “Dakota Series LLC – North” and another “Dakota Series LLC – South.”

This is the name of the parent LLC, which you will have already included in your Articles of Organization. You will also need to include the LLC’s business ID, which is something you’ll receive from the state once you file your articles.

This is the address where your series LLC receives mail. It must be a physical address, not a P.O. Box.

You will only need to fill out this section if your series is manager-managed. In this case, you would include the names and addresses of your series’s initial managers. Otherwise, leave this section blank.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

South Dakota Series LLC Operating Agreement

An operating agreement is an internal document that lays out the internal structure of your company.

Why is an operating agreement important for a South Dakota Series LLC?

An operating agreement is required to create a South Dakota Series LLC. It’s what establishes your business structure, and ultimately allows a parent company to branch out into individual series.

Do I have to write the operating agreement?

An operating agreement can be nuanced and tricky to write, so it might be best to consult a lawyer. That said, Northwest provides free templates you may browse or use as a jumping-off point for writing your South Dakota Series LLC operating agreement.

Get Federal EINs from the IRS

Does my South Dakota Series LLC need an EIN?

Yes, most businesses need a federal employer identification number (FEIN or EIN). While South Dakota businesses are exempt from some taxes, an EIN is still required for hiring employees or filing taxes as an S-Corporation. You can obtain an EIN for free from the IRS.

Learn more about how to get a Federal EIN for your business.

Should I get a separate EIN for each series of my South Dakota Series LLC?

Chances are, yes. It’s important for each series to remain separate from one another financially, and the easiest way to do this is by setting up separate bank accounts for each series. In order to do that, each series will need its own EIN.

Open Bank Accounts for Your South Dakota Series LLC

To open a bank account for your South Dakota Series LLC, you will need to bring the following with you to the bank:

- A copy of your South Dakota Series LLC Articles of Organization

- Your Series LLC operating agreement

- Your South Dakota Series LLC’s EIN

If your South Dakota Series LLC has multiple members, you may want to bring an LLC resolution with you to show that the person opening the bank account has the authorization to do so.

Should I open separate bank accounts for each series?

It’s important to show that each series maintains its own assets completely separate from one another. Opening separate bank accounts is one of the best ways to keep each of your series separate.

You might encounter some difficulty—some banks are unfamiliar with series LLCs and may not be willing to open several bank accounts for what appears to be one company. It’s best to check in with your bank beforehand, explain your business structure, and make sure your bank will be able to accommodate you.

Obtain Any Required Business Licenses

South Dakota doesn’t issue a statewide business license. But certain cities—like Aberdeen, Rapid City and Sioux Falls—require licenses for certain businesses.

You will also need to register for a sales tax license if your business conducts retail sales and has “nexus” (meaning: taxable assets). You can obtain a South Dakota Sales Tax License for free through the South Dakota Department of Revenue with your EIN.

File South Dakota Series LLC Reports

What is the South Dakota Annual Report?

The South Dakota Annual Report is required of all South Dakota LLCs to make sure their business remains current with the state. The report—due each year at the end of whichever month your Series LLC was first created—requires you to update anything that may have changed within your business over the last year. If not much has changed, writing your annual report should be a breeze.

Do I have to submit an annual report for each series within my Series LLC?

No. According to SD Codified L § 59-11-24 (2020), the individual series within a Series LLC do not have to file their own annual report. Considering the report costs $50 to file online (or $65 with paper), this can mean big savings for your business.

Let Us Be Your Guide

Interested in forming a traditional South Dakota LLC instead of a Series LLC? At Northwest Registered Agent, we’ve spent years crafting our South Dakota LLC service. When you hire us, we’ll form your South Dakota LLC for $375 total and include:

- One year of registered agent service

- An LLC operating agreement, membership certificates and LLC resolutions

- Digital notifications

- South Dakota Annual Report reminders and directions for fast filing

- A secure online account filled with intuitive business maintenance tools and forms to make LLC upkeep simple

- Lifetime Corporate Guide Service—call us anytime and one of our Corporate Guides will help you navigate whatever business problem, task or curiosity you have

Northwest Registered Agent is the only national LLC formation service that is dedicated to your personal privacy. We don’t sell data to third-parties and we do everything we can to keep your personal information secure.