How to Reinstate an Ohio LLC

To revive an Ohio LLC, you’ll need to file either a Reinstatement and Appointment of Agent form or a Certificate of Tax Clearance, depending on why your LLC was dissolved. You’ll also need to fix the problem that led to dissolution. Below, we provide a free, step-by-step guide to reinstating your Ohio LLC.

Revive An Ohio Limited Liability Company

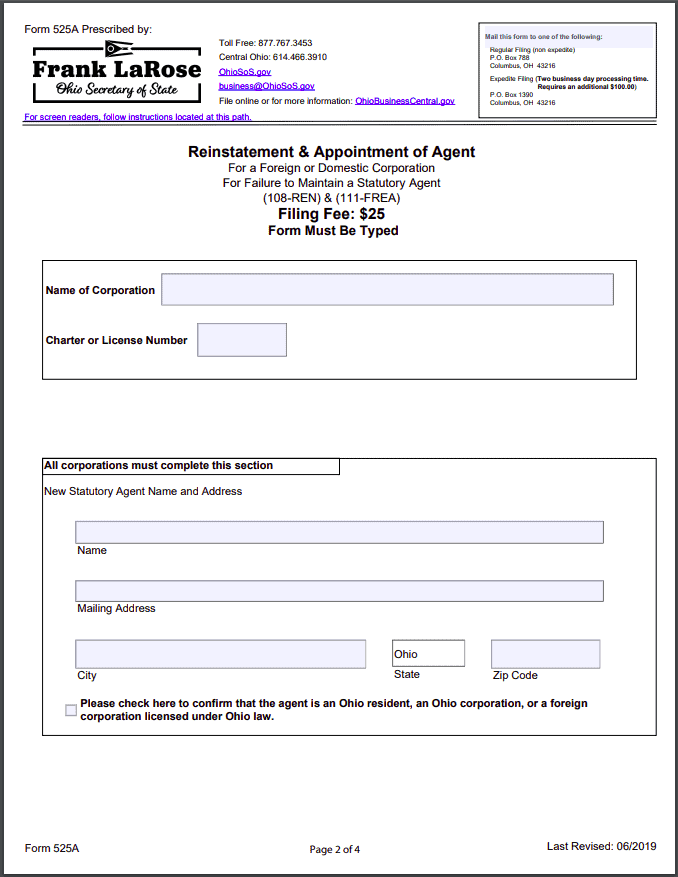

Figuring out how to reinstate an Ohio LLC can be confusing. The Ohio Revised Code doesn’t specifically address reinstatement as it pertains to LLCs, and the Ohio Secretary of State reinstatement form is labeled “For a Foreign or Domestic Corporation.”

However, the Ohio Secretary of State does administratively dissolve or “cancel” LLCs, and the process for reinstating an LLC in Ohio is nearly identical to the process of reinstating a corporation.

Your Ohio LLC may be administratively dissolved or canceled if it fails to do any of the following:

- appoint or mhttps://www.northwestregisteredagent.com/maintain-a-business/reinstateaintain a statutory agent

- properly file paperwork for changes to the statutory agent or office

- pay any fees or taxes required by law

In order to get back into business again, you can apply for reinstatement. How you revive or reinstate your Ohio LLC depends on why it was canceled in the first place.

- If your LLC was canceled due to a problem with your statutory agent, you’ll need to submit a completed Reinstatement and Appointment of Agent form (Form 525-A) and a $25 filing fee to the Ohio Secretary of State.

- If your LLC was canceled for failure to pay taxes, you’ll need to submit a Certificate of Tax Clearance and a $25 filing fee to the Ohio Secretary of State.

What information do I need for the Ohio Reinstatement form?

To file the Ohio Reinstatement and Appointment of Agent form, you’ll need to provide your LLC’s name and charter or license number. You’ll also need to provide the name and mailing address of your new Ohio statutory agent.

Your Ohio statutory agent will have to sign the “Acceptance of Appointment” section on page two. You’ll also need to provide a signature from a member or person authorized to do business on behalf of your LLC.

How do I file the Ohio Reinstatement and Appointment of Agent form?

You can submit the Ohio Reinstatement and Appointment of Agent form to the Ohio Secretary of State online or by mail:

Non-Expedited Mailed Filings:

PO Box 788

Columbus, OH 43216

Expedited Mailed Filings:

PO Box 1390

Columbus, OH 43216

Online Filings:

Ohio Online Business Portal

How much will it cost to revive an Ohio LLC?

The filing fee for a Reinstatement and Appointment of Agent is $25.

Starting at $100, you can order expedited service and speed up your filing time.

How long does it take the state to process the Ohio reinstatement?

It typically takes the Ohio Secretary of State 3-5 business days to process the Reinstatement and Appointment of Agent form.

Can you change your Ohio statutory agent on the Ohio reinstatement?

Yes. In fact, that’s the whole purpose of the Ohio Reinstatement and Appointment of Agent form—to either resolve any issues with your statutory agent’s information or to change your Ohio Registered Agent.

How long do you have to revive an Ohio LLC?

You can revive a business anytime after it’s been canceled—with one exception.

When your Ohio LLC is canceled, its name immediately becomes available for other businesses to adopt. If another business has taken your business name, you’ll need to obtain consent from that business to use your old business name. If you can’t obtain consent, you won’t be able to reinstate your LLC. You’ll need to start over and form a new Ohio LLC.

Ohio Tax Clearance

If your Ohio LLC was canceled because you failed to pay taxes, you can apply for reinstatement after you’ve paid all outstanding taxes.

To reinstate an Ohio LLC that’s been administratively canceled for tax reasons, you’ll need to obtain a Certificate of Tax Clearance from the Ohio Department of Taxation that clears you of tax liability. Then you’ll need to submit the Certificate of Tax Clearance and the $25 filing fee to the Ohio Secretary of State.

How do you get a tax clearance letter for an Ohio LLC?

To get a Certificate of Tax Clearance, you’ll need to contact the Ohio Department of Taxation’s Taxpayer Services Division to find out exactly how much you owe in taxes.

Once you’ve paid all owed taxes, the Ohio Department of Taxation will automatically mail you a Certificate of Tax Clearance.

Where do I file my Ohio Certificate of Tax Clearance?

You’ll file your Ohio Certificate of Tax Clearance with the Ohio Secretary of State. You’ll need to include your own cover letter that includes your LLC’s name and charter number. You can only file the Certificate of Tax Clearance by mail:

Non-Expedited Mailed Filings:

PO Box 788

Columbus, OH 43216

Expedited Mailed Filings:

PO Box 1390

Columbus, OH 43216