How to Start a Series LLC in Nevada

To create a Series LLC in Nevada, you’ll need to submit the LLC Articles of Organization and supporting documents to the Nevada Secretary of State online or by mail. The Nevada LLC Articles of Organization costs $75 to file, but you’ll also have to pay to file the Initial List of Managers or Members ($150) and the State Business License Application ($200), so starting Series LLC in Nevada will cost you $425 total. Filing the Articles of Organization with the state officially establishes your Nevada Series LLC, but you’ll have to take several additional steps to finish setting up your business.

Nevada Series LLC Guide

- Understand the Nevada Series LLC

- Submit NV Series LLC Articles of Organization

- File or Update BOI Report

- Create a NV Series LLC Operating Agreement

- Get Federal EINs from the IRS

- Open bank accounts for your Series LLC

- Obtain any required business licenses

- File the Annual List and Business License Form

What is a Nevada Series LLC?

A Nevada Series LLC is a special type of limited liability company that consists of a parent LLC and one or more divisions, called “series,” within itself. Each series can have its own business purpose, assets, finances, and—if properly formed and maintained—limited liability.

This means that in the case of a lawsuit, the parent LLC typically won’t be held liable for the debts of any of the series within it. Likewise, each series is protected from the liabilities of other series and the parent LLC. If formed and maintained correctly, a Series LLC can separate and protect multiple business assets in the event that another part of your organization is sued.

Series LLCs are offered in more than a dozen states. To learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC, see our Series LLC Guide.

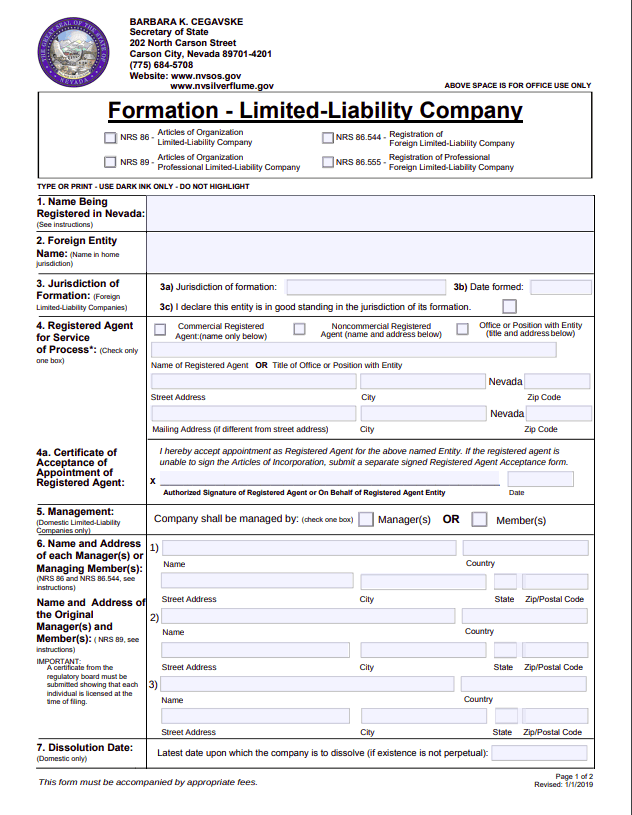

NV Series LLC Articles of Organization Requirements

To form a Nevada Series LLC, you must submit the Nevada Series LLC Articles of Organization, the Initial List of Managers or Managing Members, and the State Business License Application to the Nevada Secretary of State. These articles can also be used to form a PLLC or register a foreign LLC or PLLC, so check the box for “Articles of Organization – Limited Liability Company” at the top. See the document below and instructions for how to fill it out.

How much does it cost to start a Nevada Series LLC?

It costs $425 total to form a Nevada Series LLC. Here’s a breakdown of the fees:

Articles of Organization: $75

Initial List of Managers or Members: $150

Nevada State Business License Application: $200

You can pay by check, money order, or credit card.

How long does it take to form a Nevada Series LLC?

Online filings are usually processed within a day of being received, but you may be looking at around a month-long wait if you file with a paper form.

Does a Nevada Series LLC need a registered agent?

Yes. Per NV Rev Stat § 86.231, all Nevada LLCs need a registered agent. Your registered agent is your business’s official point of contact for important legal mail and correspondence from the Nevada Secretary of State. For a lawsuit to move forward in the courts, a business must be properly notified. When your registered agent is “served,” your business is considered legally notified. That’s a serious responsibility that we don’t take lightly.

Does each series of a Nevada Series LLC need its own registered agent?

No. Each series in your Nevada Series LLC shares a registered agent with the parent LLC.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Create a Nevada Series LLC Operating Agreement

Your Nevada Series LLC operating agreement is an internal document that describes how your LLC is structured, who owns it, which members are associated with which series, and how your LLC will handle disputes, among other issues. Per NV Rev Stat § 86.296, members can create a new series by adopting an operating agreement for that series.

How do I write a Nevada Series LLC Operating Agreement?

If you’re not a lawyer or a legal prodigy, writing a Nevada Series LLC operating agreement from scratch is going to be pretty tricky. Hire us and we’ll provide you with a general template for crafting your own operating agreement.

Get Federal EINs from the IRS

Does my Series LLC need an EIN?

Yes. An EIN is necessary for hiring employees, changing your tax designation, getting a business license, and opening a business bank account. You can apply for an EIN through the IRS website.

Should I get a separate EIN for each series in my Nevada Series LLC?

Yes. To maintain your Nevada Series LLC’s limited liability, you need to maintain separate finances for each series. That means opening separate bank accounts for each series. For separate bank accounts, you need separate EINs.

Open Bank Accounts for Your Series LLC

To open a bank account for your Nevada Series LLC, you’ll need to bring to the bank:

- A copy of your Nevada Series LLC Articles of Organization

- Your Series LLC operating agreement

- Your Series LLC’s EINs

If your Series LLC has more than one member, you might want to bring an LLC resolution to open a bank account stating that the person opening the account on behalf of the LLC is authorized to do so by the other members.

Obtain Any Required Business Licenses

Nevada requires a state business license and the application is included with the Articles of Organization. You’ll have to renew your Nevada state business license each year.

Depending on where your business is located in Nevada, you may also need to obtain a business license on the local level. For example, Washoe County requires a county-level business license for businesses operating in unincorporated parts of the county; the City of Reno requires a business license to do business in the city.

File the Nevada Annual List and State Business License Application

Every year, your Series LLC will need to file the Nevada Annual List and State Business License Application. A Series LLC will need to pay $350 total ($150 for the Annual List and $200 for the Business License Application). Luckily, Series LLCs only need to file one Annual List and State Business License Application, not one for each series.

Learn more with Northwest’s Nevada Annual Report Service & Filing Instructions.

Let Us Be Your Guide

Interested in forming a traditional Nevada LLC instead of a Series LLC? At Northwest Registered Agent, we’ve spent years crafting our Nevada LLC service. When you hire us, we’ll form your Nevada LLC for $650 total and include:

- One year of registered agent service

- An LLC operating agreement, membership certificates and LLC resolutions

- Digital notifications

- Nevada Annual Report reminders and directions for fast filing

- A secure online account filled with intuitive business maintenance tools and forms to make LLC upkeep simple

- Lifetime Corporate Guide Service—call us anytime and one of our Corporate Guides will help you navigate whatever business problem, task or curiosity you have

Northwest Registered Agent is the only national LLC formation service that is dedicated to your personal privacy. We don’t sell data to third-parties and we do everything we can to keep your personal information secure.