Revive A Nevada Limited Liability Company

The Nevada Secretary of State has the power to administratively dissolve or revoke your LLC if you fail to do any of the following:

- file annual lists (annual reports)

- appoint or maintain a registered agent

- properly file paperwork for changes to your articles of organization

- obtain a Nevada business license

- pay any fees required by law

Doing business in Nevada while your entity is revoked could result in a steep fine of up to $10,000. If you want to bring your Nevada LLC back into good standing to do business, you’ll need to submit a completed reinstatement packet to the Nevada Secretary of State. That reinstatement packet should include the following:

- Customer Order Instructions for either regular or expedited service

- a Declaration Page for claiming a Business License Exemption (if needed)

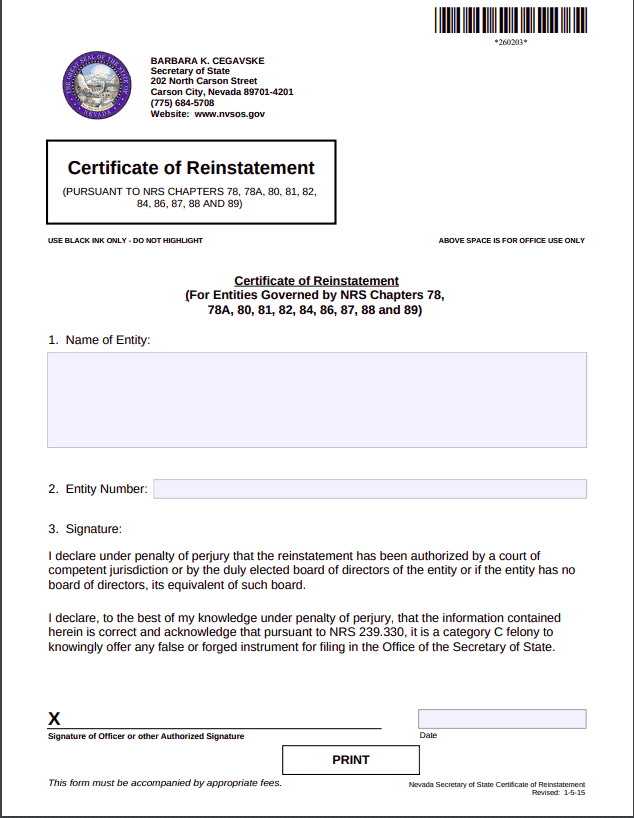

- the Certificate of Reinstatement

- an LLC Initial/Annual List

- a Registered Agent Acceptance signed by your registered agent OR a Statement of Change of Registered Agent (if changing agents)

- an Application of Reinstatement or Name Consent form (if your LLC’s name was taken while revoked)

- all owed fees and penalties

What information do I need for the Nevada Certificate of Reinstatement?

The Nevada Certificate of Reinstatement only requires your Nevada LLC’s name, entity number, and a signature from a someone authorized to do business on behalf of your LLC.

How do I file the Nevada reinstatement packet?

You can submit the Nevada reinstatement packet to the Nevada Secretary of State’s Status Division by mail, in person, or by fax. Payment options depend on how you plan to file:

- Mail: Check (payable to “Nevada Secretary of State”)

- Fax: Credit card (you’ll need to attach the ePayment checklist to your documents)

- In Person: Check or credit card

Where do I submit my Nevada reinstatement packet?

Reinstatement applications are processed by the Nevada Secretary of State’s Status Division.

How much will it cost to revive a Nevada LLC?

Nevada charges a $300 reinstatement fee. However, you’ll also have to pay separate filing fees for each form in your reinstatement packet and any applicable late fees. Calculating your total reinstatement fee can be tricky, so Nevada provides a business fee calculator online. To use it, find your Nevada LLC on the business entity database, and click “Calculate Reinstatement Fees.” You can also request a personalized breakdown of fees by calling the Customer Service Division at (775) 684-5708.

How long does it take the state to process the Nevada reinstatement packet?

The Nevada Secretary of State’s processing times vary depending on how busy the office is. Typically, business filings are processed in 10-12 business days. You can check current processing times online.

Expedited service is available for an additional fee as follows:

24-hour Service: $125 per filing

2-hour Service: $500 per filing

1-hour Service: $1,000 per filing

Can you change your Nevada registered agent on the Nevada reinstatement?

Yes. To change your Nevada registered agent, you’ll have to include the Statement of Change of Registered Agent by Entity plus a $60 filing fee.

How long do you have to revive a Nevada LLC?

You can revive a business in Nevada within five years after the date of dissolution. After that time, you’ll have to form a new Nevada LLC.

What if my Nevada LLC’s name was taken while in revoked status?

If your LLC’s name has been adopted or reserved by another business in Nevada, you’ll have to reinstate under a new name and include the Application of Reinstatement form. If you can convince the business that has taken or reserved your LLC’s name to release it to you, you can submit a completed Name Consent form instead.

By Mail and In Person:

Secretary of State

Status Division

202 North Carson Street

Carson City, NV 89701

(regular and expedited filings accepted)

Secretary of State – Las Vegas

North Last Vegas City Hall

2250 North Las Vegas Blvd, 4th Floor

North Las Vegas, NV 89030

(only expedited filings accepted)

Faxed Filings:

For regular and expedited filings: (775) 684-5708

Expedited filings only: (702) 486-2880