How to Restore a Michigan LLC

To restore a Michigan LLC, you’ll need to file the Certificate of Restoration of Good Standing with the Michigan Department of Licensing and Regulatory Affairs (LARA). You’ll also have to fix the issues that led your Michigan LLC to lose its good standing. Below, we provide a free, step-by-step guide to restoring your Michigan LLC.

Restore a Michigan LLC to Good Standing

The Michigan Department of Licensing and Regulatory Affairs (LARA) doesn’t administratively dissolve LLCs. However, it will take away your Michigan LLC’s good standing if you fail to file annual reports.

If your Michigan LLC has lost its good standing, you can still do business in Michigan. However, you won’t be able to file any other paperwork with LARA – not even to dissolve your Michigan LLC.

After two years, your Michigan LLC’s name will become available for other businesses to use.

To get your Michigan LLC back into good standing, you can apply for restoration. To restore your Michigan LLC, you’ll need to submit the following to LARA:

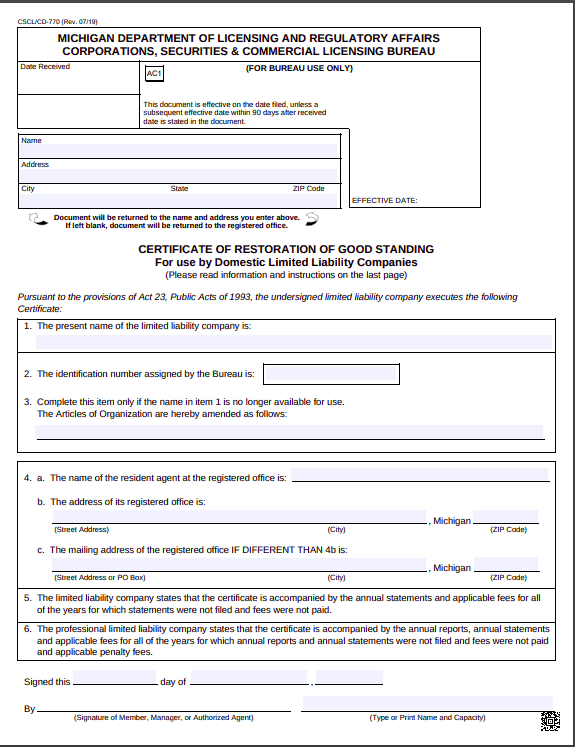

- a completed Certificate of Restoration of Good Standing (CSCL/CD-770) or your own document with the same information

- all missed annual reports

- a $50 filing fee plus $25 for each annual report filed

What information do I need for the Michigan Certificate of Restoration?

To file for restoration, you can use LARA’s Certificate of Restoration of Good Standing form or draft your own, as long as it includes the same information.

In the first section, provide the address where you’d like the form returned, unless you’d like it returned to your registered agent.

Next, you’ll need to list the following information:

- the name of your Michigan LLC

- the ID number assigned by the Bureau (if you can’t find it, leave the field blank)

- a new name (if your old name was taken)

- the name and address of your registered agent

The Certificate of Restoration also states that you’re including the missed annual reports and fees that are due.

Who can sign the Michigan Certificate of Restoration?

It depends on how your Michigan LLC is managed. If its member-managed, a member must sign. If it’s manager-managed, a manager must sign. In both cases, a person authorized to act on the LLC’s behalf may sign.

How do I file the Michigan Certificate of Restoration?

You can submit the Michigan Certificate of Restoration to LARA online, by mail or in person. Payment options depend on how you plan to file.

- Online: Credit card

- Mail: Check or money order (payable to “the State of Michigan”)

- In Person: Credit card, check or money order (payable to “the State of Michigan”)

How much will it cost to restore a Michigan LLC?

The filing fee for a Certificate of Restoration is $50. Expediting costs extra.You’ll also need to include $25 for each missed annual report.

How long does it take the state to process the Michigan Certificate of Restoration?

LARA takes about 3-5 business days to process the Certificate of Restoration.

Expedited service service is available as follows:

- $100 for 24-hour service

- $200 for same-day service

- $500 for two-hour service

- $1,000 for one-hour service

If expediting, you’ll need to include a separate CSCL/CD-272 Form.

Can you change your Michigan registered agent on the Michigan Certificate of Restoration?

Yes, you can change your Michigan registered agent on the Certificate of Restoration.

How long do you have to restore a Michigan LLC?

You can restore a business in Michigan at any time. However, two years after losing your good standing, your name becomes available for other businesses to adopt.

Where do I submit my Michigan Certificate of Restoration?

The Certificate of Restoration is processed by the Michigan Department of Licensing and Regulatory Affairs Corporations, Services, & Commercial Licensing Bureau.

Mailed Filings:

Corporations Division

P.O. Box 30057

Lansing, MI 58909

In-Person Filings:

2501 Woodlake Circle

Okemos, MI 48864

Online: