How to Start a Kansas Series LLC

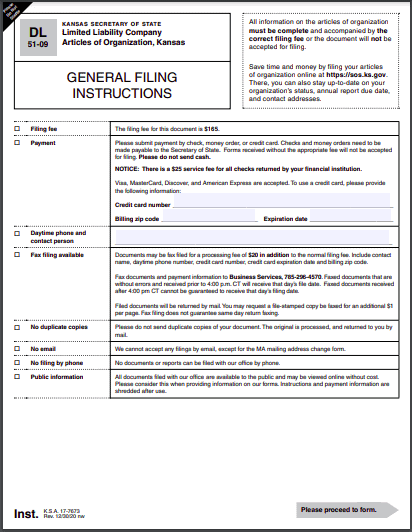

To create a series LLC in Kansas, you must first file Articles of Organization with the Secretary of State ($165 minimum), then file a separate Certificate of Designation ($35) for each individual series. All documents can be filed online or by mail. Fax filings are an additional $20.

Filing your Articles of Organization and Certificate(s) of Designation will establish your Series LLC, but there are some additional steps you’ll need to take before your business is fully set up.

Kansas Series LLC Guide:

What is a Kansas Series LLC?

A Kansas Series LLC is a business structure that allows one limited liability company (LLC) to act as a parent company that can branch off into one or more separate companies, called “series.” Even though each series is connected to the parent company, the individual series are seen as their own unique businesses. That means that each series within a Kansas Series LLC, if properly formed, can keep its assets separate from its parent company, as well as any other series within the Series LLC.

Why create a Kansas Series LLC?

This business model is helpful for protecting individual company’s assets because each series within the Series LLC is not liable for any other, assuming the parent LLC and all its series are in line with KS Stat § 17-76,143 (all paperwork is properly filed and maintained, distinct records are kept for each series, etc.).

This business model can be helpful for individually protecting assets without the need for creating multiple LLCs. The parent LLC and each series have separate liability—assuming the parent LLC and all its series are in line with KS Stat § 17-76,143 (all paperwork is properly filed and maintained, distinct records are kept for each series, etc.).

In other words, if one series faces debt or legal trouble, the other businesses within the Series LLC wouldn’t be responsible for any losses or litigation—their individual assets would remain safe.

Why not just make a bunch of LLCs?

In short: it’s expensive. Since filing Articles of Organization in Kansas costs $165, you would have to pay at least that much every single time you create a new LLC. With a Kansas Series LLC, creating a new business (or “series”) within a parent company only costs $35 per series for initial filing fees. That’s a savings of $130 each time you start a new series!

To read more about how Series LLCs work and which states recognize them, check out our Series LLC Guide.

Kansas Series LLC Articles of Organization Requirements

To create a Kansas Series LLC, you must first file Articles of Organization with the Kansas Secretary of State. This is the same document you would file to create a traditional LLC. The only difference with a Series LLC is that you’ll also be filing a document known as a Certificate of Designation for each individual series.

See the document below and click on any number to read more about each step in the process of creating your articles.

How much does it cost to register a Kansas Series LLC?

Kansas Articles of Organization cost $166 to file online ($160 plus credit card processing fees), and $165 to file by mail or in person. You may also fax your articles for a total of $185.

How long does it take to register a Kansas Series LLC?

The state generally takes 3-5 business days to process paper filings once they receive them. Online filings are processed within 24 hours of receipt.

Does a Kansas Series LLC need a registered agent?

Yes. Kansas state law requires LLCs to file Articles of Organization that include the name and address of the LLC’s registered agent (also called a “resident agent”). The registered agent is the person or entity that will accept official documents, like legal notices, on behalf of the business.

Does each series of a Kansas Series LLC need its own registered agent?

No. Each individual series must use the same resident agent listed in the Articles of Organization.

Submit a Certificate of Designation for Each Series

In addition to filing your articles, you’ll need to create a Certificate of Designation for each series within your Series LLC. The Certificate of Designation looks similar to the Articles of Organization, but will include information specific to each series. There is a $35 filing fee for each certificate. The certificate requires the following information:

1. Name of Limited Liability Company

This is the company name you used to file your Articles of Organization. You should include the name here exactly as it appears in your articles.

2. Business Entity/ID File Number

In Kansas, each business entity receives a “business entity ID number” from the state. You will receive this number after filing your Articles of Organization.

3. Name of Series

Each series’s name must include the name of the LLC, in full along with a unique, identifying name. For example, if your parent company is called Wicked Witch Series LLC, one series might be named Wicked Witch Series LLC – East and another Wicked Witch Series LLC – West.

4. Mailing Address

This is where the Secretary of State’s office will send official mail from the state. It’s not the same as your resident agent’s mailing address, which is where the state will send legal notices. However, like the resident agent’s address, this address will also be made public.

5. Tax Closing Month

Just as with your articles, this refers to the end of your fiscal year. If your business follows the regular calendar year, you’d put “December.” If your business follows a different fiscal calendar, you’d put the last month of that fiscal year.

6. Signature(s)

Each Certificate of Designation must be signed by someone authorized to do business on behalf of that particular series.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Kansas Series LLC Operating Agreement

Why is an operating agreement important for a Kansas Series LLC?

An operating agreement is important for any business because it lays out what the day-to-day operations of a company will look like. It’s also the document that defines a company’s business structure, including whether or not the company can branch out into separate series.

Do I have to write my own operating agreement?

Creating an effective operating agreement can be tricky, so we recommend working with an attorney to creating your Kansas Series LLC Operating Agreement. That said, we provide free templates you may use to get started on your operating agreement:

Get Federal EINs from the IRS

Does my Kansas Series LLC need an EIN?

Yes, getting a federal employer identification number (FEIN or EIN) is necessary for most businesses. You’ll need an EIN if you want to hire employees or take advantage of tax designations like S-Corp. In most cases, you’ll also need an EIN to open a bank account or get a local business license. You can get an EIN for free through the IRS website.

Should I get a separate EIN for each series of my Kansas Series LLC?

Most likely, yes. In order to establish limited liability, you’ll want to keep the assets of each series separate, which usually means opening separate bank accounts for each one. Each series will need its own EIN to open a bank account.

Open Bank Accounts For Your Kansas Series LLC

To open a bank account for your Kansas Series LLC, you will need to bring the following with you to the bank:

- A copy of your Articles of Organization

- Your Series LLC operating agreement

- You Kansas Series LLC’s EIN

If your Kansas Series LLC has multiple members, you might want to bring an LLC resolution with you to the bank. That way, you’ll have an official document showing that the person at the bank is authorized to open an account on behalf of your company.

Should I open separate bank accounts for each series?

You’ll want to keep each series’s finances separate in order to maintain limited liability within your Kansas Series LLC. Opening bank accounts for each individual series is the best way to do that.

Since Series LLCs are a relatively new business structure, some banks may not be accustomed to starting multiple bank accounts for what appears to be a single LLC. You might want to call your bank ahead of time to explain your company’s business structure and make sure the bank will be able to accommodate each individual series.

Obtain any Required Business Licenses

Kansas doesn’t have a specific business license, but almost all businesses will need to register for assorted business taxes, which can include (among others) Retailer’s Sales Tax, Withholding Tax, Corporate Income Tax, and more. Depending on what kind of business you’re involved in and where you’re located, you might need a specific state, county, city, or professional (barbers, engineers, etc…) business license.

File Kansas Series LLC Reports

What is the Kansas Biennial Report?

The Kansas Biennial Report is basically a way to keep your business information updated with the state.

When should I file the Kansas Biennial Report?

You’ll file your biennial report based on when you formed your Series LLC. If you formed it on an even year (ex: 2018, 2020, 2022, etc…), you’ll file your report on even years. Businesses that were formed in an odd year file reports in each succeeding odd year. Reports will still be due on April 15th.

Do I have to submit a report for each series within my Series LLC?

Yes, each series must file its own biennial report. The filing fee is $100 for online filings (plus a $3 convenience fee), or $100 for filing by mail.

Let Us Be Your Guide

Interested in forming a traditional Kansas LLC instead of a Series LLC? At Northwest Registered Agent, we’ve spent years crafting our Kansas LLC service. When you hire us, we’ll form your LLC for $391 total and include:

- One year of registered agent service

- An LLC operating agreement, membership certificates and LLC resolutions

- Digital notifications

- Kansas Biennial Report reminders and directions for fast filing

- A secure online account filled with intuitive business maintenance tools and forms to make LLC upkeep simple

- Lifetime Corporate Guide Service—call us anytime and one of our Corporate Guides will help you navigate whatever business problem, task or curiosity you have

Northwest Registered Agent is the only national LLC formation service that is dedicated to your personal privacy. We don’t sell data to third-parties and we do everything we can to keep your personal information secure.