How to Start a Series LLC in Indiana

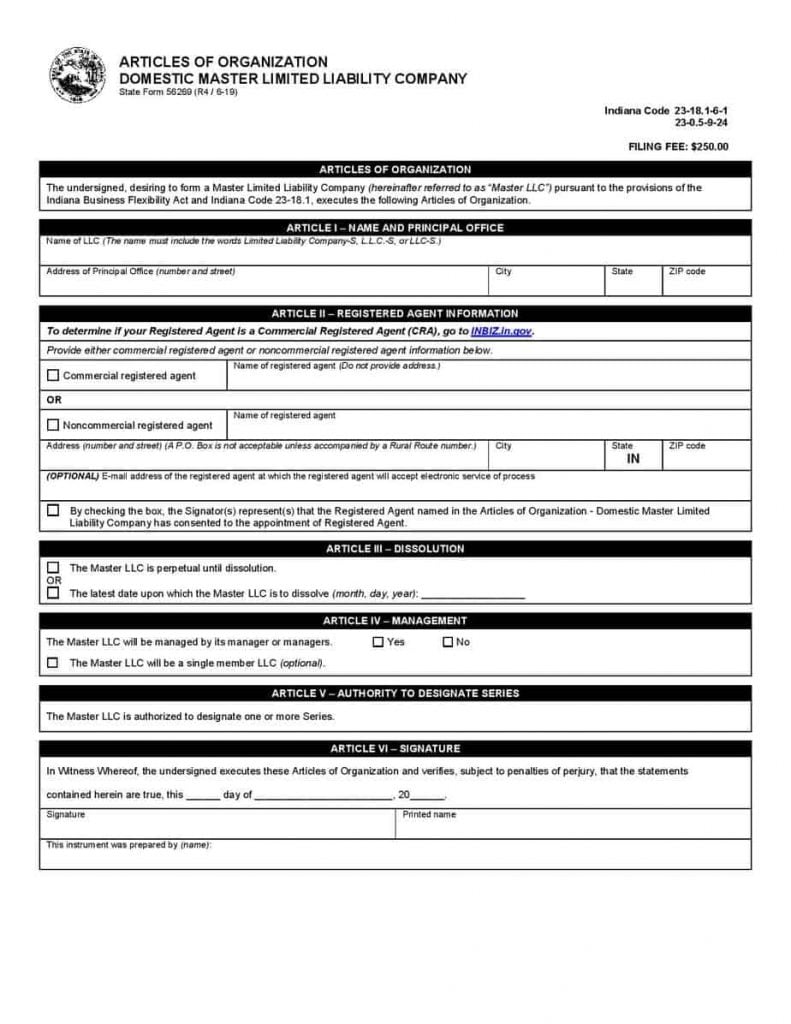

To start a Series LLC in Indiana, you must file a document with the Indiana Business Services Division called the Articles of Organization Domestic Master Limited Liability Company. You can submit this document online, by mail, or in person. The Articles of Organization for your Indiana Series LLC cost $250 to file.

The steps to starting an Indiana Series LLC are similar to the steps to starting a traditional limited liability company in Indiana, but there are several important differences you will need to know. The following how to start a Series LLC in Indiana guide will help get you started.

Indiana Series LLC Guide:

- Understand the Indiana Series LLC

- Submit IN Series LLC Articles of Organization

- Submit Articles of Designation for each series

- File or Update BOI Report

- Create an IN Series LLC Operating Agreement

- Get Federal EINs from the IRS

- Open bank accounts for your IN Series LLC

- Obtain any required business licenses

- File the Indiana Business Entity Report

What Is an Indiana Series LLC?

The Indiana Series LLC is a special type of limited liability company (LLC). Like a traditional Indiana LLC, the Indiana Series LLC is a legal entity separate from its owners (called members) and has the basic rights of any legal business entity. It can hold its own assets, enter into contracts, sue and be sued, and maintain its own finances.

Unlike a traditional LLC, however, an Indiana Series LLC can create divisions within itself, called “series,” that have most of the same abilities as their parent company (often called the “Master LLC”). Each series of an Indiana Series LLC, like the organization’s Master LLC, can hold its own assets, have its own business purposes, sue and be sued, and enter into contracts.

If the Master LLC and each of its series are properly formed and maintained, each series of an Indiana Series LLC will typically not be liable for legal actions taken against the Master LLC or any other series within it. This is similar to starting multiple, completely independent LLCs to operate different businesses or hold separate assets, but the Indiana Series LLC only requires Articles of Organization to be filed for one entity (the Master LLC). Each series of an Indiana Series LLC are then formed by filing Articles of Designation for each series.

The Series LLC was first created in Delaware and has since spread to several states. Learn more about this unique business structure at Northwest’s Series LLC Guide.

IN Series LLC Articles of Organization Requirements

To form an Indiana Series LLC, you must submit a document called “Articles of Organization Domestic Master Limited Liability Company.” You can submit this document by mail, in person, or online at Indiana’s InBiz website. See the document below and click on any number to find out what information is required in the corresponding section.

How much does it cost to start an Indiana Series LLC?

It costs $250 to file Articles of Organization for an Indiana Series LLC. The state charges an additional $30 to file Articles of Designation, which you will need to submit for each series of your Series LLC that you decide to form.

How long does it take to form an Indiana Series LLC?

If you file online, the state’s response time is typically within a day of receipt. Mailed filings usually take between 5-7 business days to process (not including mailing time).

Does an Indiana Series LLC need a registered agent?

Yes, an Indiana Series LLC needs an Indiana registered agent to receive service of process and other official state notifications on its behalf. The registered agent must maintain an office at a street address in Indiana and be available at that location during ordinary business hours. Essentially, a registered agent provides a consistent point of contact between your Indiana Series LLC and the state in case any part of your organization ever gets sued.

Does each series of an Indiana Series LLC need its own registered agent?

No. Your Indiana Series LLC’s Master LLC and each individual series can share the same registered agent. Just keep in mind that many registered agents will charge additional fees for each series of your Indiana Series LLC.

Indiana Articles of Designation Requirements

To form a series of your Indiana Series LLC, you must submit Articles of Designation to the Indiana Secretary of State’s Business Services Division. The Indiana Articles of Designation cost $30 to file. You can submit this document online, in person, or by mail. You must submit separate Articles of Designation (and pay a separate $30 filing fee) for each series of your Indiana Series LLC.

You will use the Articles of Designation to form, amend, and dissolve a series of your Indiana Series LLC. If you are forming a new series, you will provide the following basic information:

- The name of your Master LLC (from your Articles of Organization)

- The name of the series you intend to form, which must include the entire legal name of the Master LLC

- Whether the series will be member-managed or manager-managed

- The printed name and signature of the person authorized to complete and submit the form

The form also contains sections for amending and dissolving series. To see each section, you can access the Indiana Articles of Designation here.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Indiana Series LLC Operating Agreement

Why is an operating agreement important for an Indiana Series LLC?

Your Indiana Series LLC’s operating agreement will define your organization’s structure, management, and operating procedures, which makes it one of your Series LLC’s most important internal documents. Your Indiana Series LLC’s operating agreement, along with its Articles of Organization and Articles of Designation, will authorize your organization to form and dissolve series, and you will amend your operating agreement each time a new series gets formed or dissolved.

Do I have to write the Operating Agreement?

Considering the complexity of the Indiana Series LLC business structure, we recommend seeking the guidance of a qualified attorney when writing an operating agreement for your Indiana Series LLC, but that doesn’t mean you have to start from scratch. At Northwest, we provide numerous free templates for creating operating agreements and other LLC-related documents, and you can use these templates as starting points for crafting documents that fit your company’s needs.

Here are just a few of the LLC forms available from Northwest Registered Agent:

Get Federal EINs from the IRS

Does an Indiana Series LLC need an EIN?

Your Indiana Series LLC will need an employer identification number (FEIN or EIN) if you wish to hire employees, open bank accounts, or take advantage of the S corporation tax election. Fortunately, you can get an EIN for free at the IRS website. It’s a fairly fast and simple application process.

Should I get a separate EIN for each series of my Indiana Series LLC?

Each series of your Indiana Series LLC will need its own EIN to open its own bank account or hire its own employees (if applicable), so the answer is likely yes. However, the application process may take some time depending on how many series you intend to form. The IRS only allows a single responsible party to apply for one EIN per day.

Learn more about how to get a Federal EIN for your business.

Open Bank Accounts for Your Indiana Series LLC

To open a bank account for your Indiana Series LLC (the Master LLC), you will likely need to bring the following documents with you to the bank:

- Your Indiana Series LLC Articles of Organization

- Your Series LLC Operating Agreement

- Your Indiana Series LLC’s EIN

If your Indiana Series LLC has more than one member, you might also want to bring an LLC resolution for opening a bank account. This will ensure the bank recognizes you (or your associate) as authorized to open an account in the name of your Indiana Series LLC.

Should I open separate bank accounts for each series of my Indiana Series LLC?

Keeping separate finances is an important part of preserving each series’ separate limited liability protections, so it’s typically crucial for each series of your Indiana Series LLC to have its own bank account.

Keep in mind, however, that many banks are unfamiliar with the Series LLC business structure, so you’ll need to plan carefully. Be sure to call the bank ahead of time, explain your situation, and ask if the bank is willing to open separate accounts for each series of your Indiana Series LLC.

Obtain Any Required Business Licenses

Will my Indiana Series LLC need a business license?

The answer depends on where your Indiana Series LLC, as well as its individual series, operates in the state. Indiana doesn’t issue a statewide business license, but some cities and counties have licensing requirements of their own.

Indiana Series LLC Business Entity Report

What is the Indiana Business Entity Report?

The Indiana Business Entity Report is how the state keeps current information about your company. The Business Entity Report gets filed every two years to update or confirm your company’s ownership and contact information. The report costs $50 if submitted by mail and $32 if submitted online.

Do I have to submit a Business Entity Report for each series of my Indiana Series LLC?

The individual series of your Indiana Series LLC, however, are not required to file this report. The Master LLC files the Business Entity Report on behalf of the entire organization.

Learn more at Northwest’s guide on the Indiana Business Entity Report.