How to File an Indiana LLC Amendment

To amend your initial Articles of Organization for an Indiana LLC, you’ll need to file Articles of Amendment with the Indiana Secretary of State, Business Services Division. In addition, you must pay the $30 paper filing fee or $20 online filing fee, depending on how you choose to submit your form. Here is a quick, step-by-step guide to amending your articles yourself.

Amend Articles of Organization for an Indiana LLC

Over time, you may need to update the information provided on your initial Articles of Organization. For the most part, these changes can be made by filing Articles of Amendment.

When do I need to file Indiana LLC Articles of Amendment?

Your LLC in Indiana files articles of amendment to update the entity’s name, duration, member/manager information, principal/mailing address, or to change your Indiana registered agent. You can also use this form to convert your Indiana LLC to a Domestic Master LLC.

What do I include in the Indiana LLC Articles of Amendment?

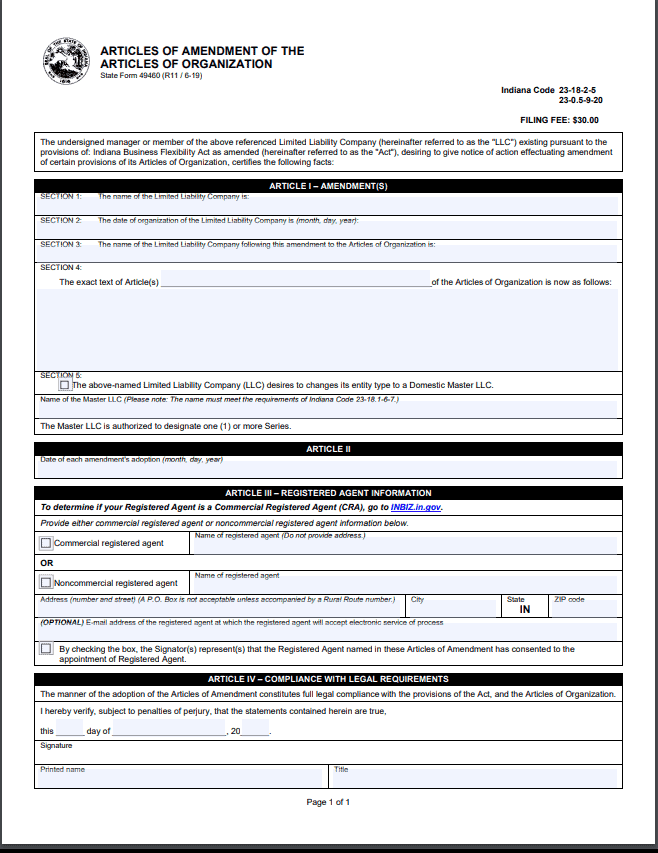

To complete the Articles of Amendment, you must include the following information:

- Business name: Provide the full name of your Indiana LLC.

- Date you initially filed Articles of Organization: Include the day, month, and year the Articles of Organization were submitted. If you don’t know the exact date, you can find it by searching the Indiana Business Database.

- Amendment: Write the necessary amendments in section 4 of the form. You’ll also need to write the exact date each amendment was or will be adopted.

- Signature: Sign and print the name and title of the person filing the amendment. This can be a member/manager or someone who is authorized to act on your LLC’s behalf.

- Fees: Include a payment for $30 (paper) or $20 (online).

How do I file the Indiana LLC Articles of Amendment?

You can submit the Indiana Articles of Amendment by mail, in person, or online. Paper filings must be paid with a check/money order made payable to “Secretary of State.” Online submissions must be paid with a credit card.

To file online, you’ll need to log into your INBIZ account OR create one by clicking “Sign up now.” Once you’re logged in, select “Business Amendment” under the “Online Services” tab. Enter your entity’s name in the search box and choose your LLC from the search results. Click “next” and complete the online amendment.

How much does an Indiana LLC amendment cost?

It depends on how you file your amendment. Paper filings will cost $30 and online submissions will cost $20. There are no options for expedited service.

How long does it take to process an Indiana LLC amendment?

Indiana Articles of Amendment will take 3-5 business days to be processed if you file by paper and 24 hours if you submit online.

Can I restate the initial articles instead of filing an Indiana LLC amendment?

Yes, you can restate your initial articles instead of filing an amendment; however, the state doesn’t provide a form—you will have to generate your own. Your restatement must be titled “Restated Articles of Organization” and include the entity’s current name along with any necessary amendments. There is a $30 filing fee.

Where do I submit Indiana LLC Articles of Amendment?

Amendments to articles are filed with the Indiana Secretary of State, Business Services Division.

Mailed/In-Person Filings:

302 West Washington Street, Room E018

Indianapolis, IN 46204

Phone: (317) 232-6576

Online Filings:

INBIZ