How to Start an Illinois Series LLC

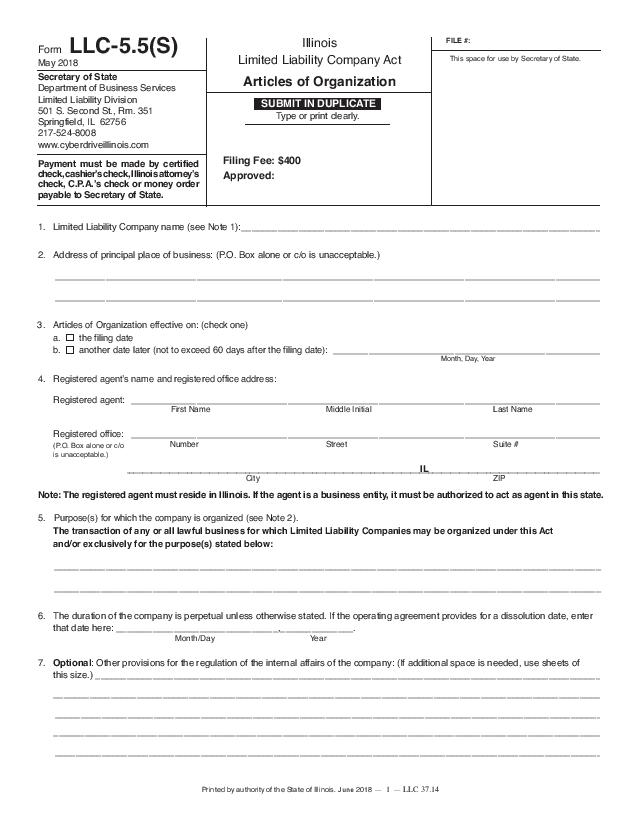

To create a Series LLC in Illinois, you must submit Articles of Organization (Form LLC-5.5(S)) to the Illinois Secretary of State. This document can be submitted by mail or online. The Articles of Organization for an Illinois Series LLC cost $400 to file. Once filed with the state, your Articles of Organization officially create your Illinois Series LLC, but truly preparing your organization to do business requires several additional steps.

Illinois Series LLC Guide:

- Understand the Illinois Series LLC

- Submit IL Series LLC Articles of Organization

- Submit Certificates of Designation

- File or Update BOI Report

- Create an IL Series LLC Operating Agreement

- Get Federal EINs from the IRS

- Open bank accounts for your Series LLC

- Obtain any required business licenses

- File the Illinois Series LLC annual report

What is an Illinois Series LLC?

Illinois is one of more than a dozen states that allow for the formation of a Series LLC. A Series LLC is a special type of limited liability company consisting of a parent LLC and one or more divisions within itself, called “series,” that can have separate assets, finances, business purposes, and limited liability. The Series LLC model basically allows you to segregate and protect your business assets if your parent organization or any of its series ever gets sued.

Series LLCs are offered in more than a dozen states. To learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC, see our Series LLC Guide.

IL Series LLC Articles of Organization Requirements

To form an Illinois Series LLC, you must submit Form LLC.5.5(S), the Series LLC Articles of Organization, to the Illinois Secretary of State. See the document below and click on any number to see what information is required in the corresponding section.

How much does it cost to start an Illinois Series LLC?

The Illinois Secretary of State charges $400 to file Series LLC’s Articles of Organization, and you can pay an additional $100 for expedited processing. Illinois also charges a credit card processing fee based on the total amount of your transaction.

How long does it take to form an Illinois Series LLC?

Normal processing take about 10 business days after the state receives your articles, but you can pay an additional $100 for expedited processing and the state will process your filing within one business day of receiving it.

Does an Illinois Series LLC Need a Registered Agent?

Absolutely. Your Series LLC is required to appoint and maintain an Illinois registered agent to receive service of process (legal notices) on its behalf. A registered agent must be available during ordinary business hours at an Illinois street address listed on your company’s Articles of Organization.

Does Each Series Need a Different Registered Agent?

No. Your Series LLC’s Illinois registered agent should be the registered agent for each individual series within your Series LLC. If your Illinois Series LLC registers as a foreign entity in another state, however, you will need to appoint a registered agent in that state as well.

Illinois Certificate of Designation Requirements

When you submit your Illinois Series LLC Certificate of Formation, you’re establishing the parent organization—the “master” LLC—but not the individual series within it. Establishing individual series requires an additional state filing called the Illinois LLC Certificate of Designation (Form LLC-37.40), which must be filed for each series within your Series LLC that you wish to form. The Illinois Secretary of State charges $50 for each Certificate of Designation.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Illinois Series LLC Operating Agreement

You’re required to create an operating agreement when starting an Illinois Series LLC. This is the document that describes how your organization functions and which members are associated with which series within your Illinois Series LLC (along with numerous other details). Your operating agreement must also allow for the establishment of individual series within your Illinois Series LLC.

It isn’t easy to write an effective Series LLC operating agreement on your own, so you should consider seeking the guidance of an experienced attorney. We can’t help you there, but we provide a general template for creating an LLC operating agreement that you can use as a jumping-off point for writing an operating agreement for your Illinois Series LLC. You’ll find this and other free LLC templates below:

Get Federal EINs from the IRS

Does My Illinois Series LLC Need a Federal EIN?

Yes, getting a federal employer identification number (FEIN or EIN) is pretty much a must for any Illinois series LLC. You’ll need an EIN if you’re going to hire employees, take advantage of tax elections like the S corporation, or get Illinois business licenses. Most banks will also expect your series LLC to have an EIN to open a bank account. You can get an employer identification number through the IRS website, by fax, or by mail.

Should I Get a Separate EIN for Each Series in My Illinois Series LLC?

Most likely, yes. One of the most important things to do when establishing an Illinois Series LLC is to maintain each series’ limited liability, and that means maintaining separate finances and financial records. This means you’ll need to establish separate bank accounts for each series, which will likely require each series to get its own EIN.

Open Bank Accounts For Your Series LLC

To open a bank account for your Illinois Series LLC, you will need to bring the following with you to the bank:

- A copy of your Illinois Series LLC Articles of Organization

- Your Series LLC operating agreement

- Your Illinois Series LLC’s EIN

If your Illinois series LLC has multiple members, you may also want to bring an LLC resolution to open a bank account that states that the person going to the bank is authorized by the members to open the account in the name of the LLC.

Should I open separate bank accounts for each series?

Opening separate bank accounts (and keeping separate finances) is crucial to maintaining each series’ limited liability, so it isn’t a good idea for your parent LLC and its individual series to share the same bank account.

Fair warning: it may not be easy. Many banks are unfamiliar with the Series LLC business structure and may not understand why the series within your Illinois Series LLC need separate bank accounts. Be sure to call the bank ahead of time, explain your situation, and confirm that the bank will open separate bank accounts for each individual series.

Obtain any Required Business Licenses

Illinois doesn’t require a statewide business license, but some cities and counties have licensing requirements of their own. This will likely require a great deal of research on your part, but visiting the Registration, Licenses, & Permits portal at Illinois.gov is a good place to start.

File Illinois Series LLC Reports

What is the Illinois Annual Report?

As with ordinary LLCs, Illinois requires Series LLCs to submit an Illinois annual report to remain in good standing with the state. The annual report updates (or merely confirms) your Series LLC’s information on the state’s records, including your registered agent information among other details. You can submit your Series LLC’s annual report online at the Illinois Secretary of State’s website. The annual report for an Illinois Series LLC costs $75 for the master series and an additional $50 for each child series, and it must be submitted annually before the first day of the month in which your organization was formed.

Do I have to submit an annual report for each series within my Series LLC?

No. This is one of the main advantages an Illinois Series LLC has over starting multiple, independent LLCs in Illinois. Your series organization will submit a single annual report each year, though the report’s filing fee will go up $50 for each child series within your Illinois Series LLC.