How to Reinstate an Illinois LLC

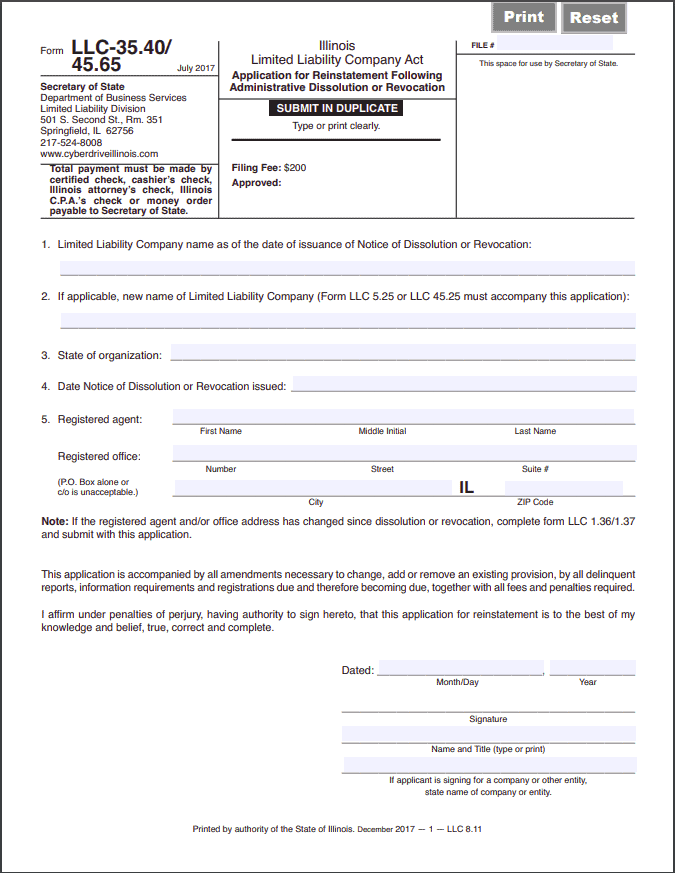

To revive an Illinois LLC, you’ll need to file the Application for Reinstatement Following Administrative Dissolution or Revocation (Form LLC 35.40/45.65) with the Illinois Secretary of State’s Department of Business Services. You’ll also have to fix the issues that led to your Illinois LLC’s dissolution. Below, we provide a free, step-by-step guide to reinstating your Illinois LLC.

Revive Or Reinstate An Illinois Limited Liability Company

The Illinois Secretary of State has the power to administratively dissolve your Illinois LLC if you fail to do any of the following:

- file annual reports

- appoint and maintain a registered agent

- pay any fees or penalties

To reinstate an involuntarily dissolved LLC in Illinois, you can apply for reinstatement. To do so, you’ll need to submit the following to the Illinois Secretary of State:

- a completed Application for Reinstatement Following Administrative Dissolution or Revocation (Form LLC-35.40/45.65)

- Articles of Amendment or Amended Application for Admission if your name was taken

- Statement of Change of Registered Agent and/or Office, if changing your registered agent

- all missing annual reports

- all owed fees and penalties

Note: The Illinois Secretary of State requires you to file all paperwork in duplicate.

What information do I need for the Illinois Application for Reinstatement?

To complete the Illinois reinstatement form, you’ll need to provide the following information:

- your LLC’s name before it was dissolved

- a new name, if needed

- the date of dissolution

- the name and address of your registered agent

The Illinois reinstatement form also includes a signed statement affirming that you’ve corrected the problems that led the SOS to administratively dissolve your Illinois LLC.

A member, manager, or authorized person must sign the Application for Reinstatement.

How do I file the Illinois Application for Reinstatement?

You can submit the Illinois reinstatement form to the Illinois Secretary of State’s Department of Business Services online, by mail, or in person. Payment options depend on filing method.

- Mail or in person: Certified check, cashier’s check, Illinois attorney’s check, Illinois C.P.A.’s check, or money order made payable to “Secretary of State.”

- Online: Credit card

How much will it cost to revive an Illinois LLC?

The filing fee for the Illinois reinstatement form is $200. You’ll also have to pay the filing fee for all missed annual reports and late fees ($100 per late report). You’ll also have to pay filing fees if you need to change your LLC’s name or registered agent ($50).

How long does it take the state to process the Illinois Application for Reinstatement?

The Department of Business Services will respond to your reinstatement application within 10 business days (24 hours expedited).

Can you change your Illinois registered agent on the Illinois reinstatement form?

You can’t use the Illinois Application for Reinstatement to change your registered agent. However, you can file the Statement of Change of Registered Agent and/or Registered Office with your Application for Reinstatement to change your Illinois registered agent.

How long do you have to revive an Illinois LLC?

You can revive a business in Illinois at anytime. However, your name is only reserved for three years. After that, it becomes available for other companies to adopt.

What if my name was taken during dissolution?

If another business has adopted your name, you’ll need to change your name by filing Articles of Amendment when you file your Application for Reinstatement.

Where do I submit my Illinois Application for Reinstatement?

Reinstatement applications are processed by the Illinois Secretary of State’s Department of Business Services.

Mailed and In-Person Filings:

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756