How to Reinstate a Delaware LLC

To revive a Delaware LLC, you’ll need to file the Certificate of Revival with the Delaware Division of Corporations. You’ll also have to fix the issues that led to your Delaware LLC’s dissolution and pay any owed taxes. Below, we provide a free, step-by-step guide to reviving your Delaware LLC.

Revive A Delaware Limited Liability Company

Delaware’s Division of Corporations has the power to cancel your Delaware LLC’s Certificate of Formation if you fail to do any of the following:

- pay the annual franchise tax for 3 years

- appoint and maintain a registered agent

If Delaware has canceled your LLC, you’ll need to submit the following to the Delaware Division of Corporations to get back into business:

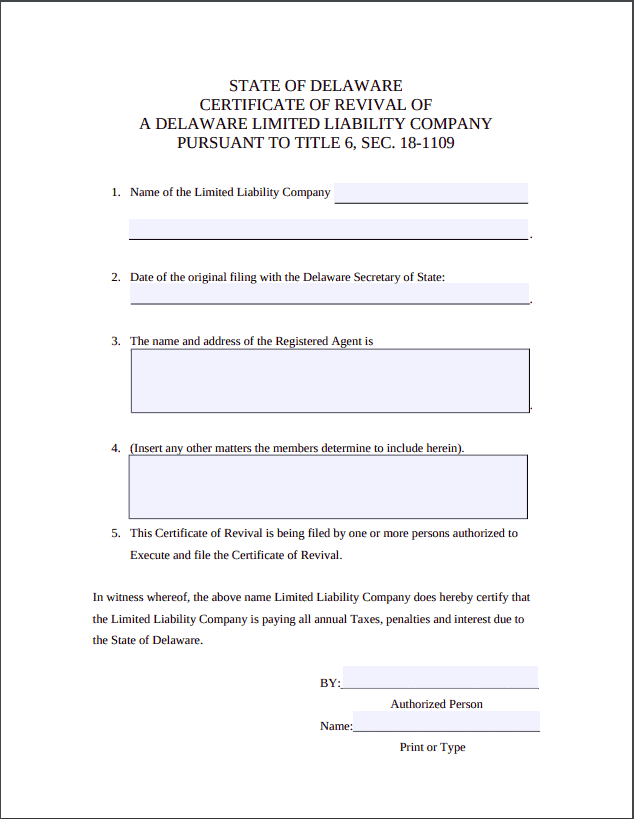

- a completed Certificate of Revival of a Delaware Limited Liability Company

- any past due tax payments

- a cover letter/memo, if filing by mail

What information do I need for the Delaware Certificate of Revival?

The Delaware Certificate of Revival is a one-page document that requires some basic information about your Delaware LLC, including its name, date of original filing, and registered agent information.

Mailed filings also require an attached cover letter/memo. You can use the Document Filing Sheet provided by Delaware Division of Corporations or create your own, as long as it includes the same information.

Electronic filings don’t require a cover letter/memo.

If your Delaware LLC was canceled for an overdue franchise tax, you’ll need to call the Delaware Franchise Tax Department at (302) 739-3077 ext. 1863 to find out your exact bill.

How do I file the Delaware Certificate of Revival?

You can submit the Delaware Certificate of Revival in person, by mail, or online. Delaware no longer accepts filings by fax.

Note: The online document upload service is only available Monday through Thursday from 7:45 AM to 11:59 PM EST and on Friday from 7:45 AM to 10:30 PM EST. You can’t use it during holidays or weekends.

Payment options depend on how you plan to file:

- Mail: Check (payable to “Delaware Secretary of State”)

- Online: Credit card or ACH bank transfer

- In person: Cash, check, money order, or credit card

How much will it cost to revive a Delaware LLC?

The filing fee for a Delaware Certificate of Revival is $200.

You’ll also have to pay any overdue taxes, including the franchise tax ($300 per year) plus the late penalty ($200) and any interest accrued.

How long does it take the state to process the Delaware Certificate of Revival?

It typically takes Delaware’s Division of Corporations 10-15 days to process filings. During March, June, and December, wait times can be as long as 3-4 weeks.

Expedited service is available year round as follows:

24 Hour Fee: $100

Same Day Fee: $200

Two Hour Service: $500

One Hour Service: $1,000

Can you change your Delaware registered agent while reviving your Delaware LLC?

Yes. You can change your Delaware registered agent on the Certificate of Revival.

How long do you have to revive a Delaware LLC?

You can revive a business in Delaware any time.

Where do I submit my Delaware Certificate of Revival?

By mail:

Delaware Division of Corporations

401 Federal Street Suite 4

Dover, DE 19901

Online: eCorp Business Services