How to Start an Arkansas Series LLC

To start a Series LLC in Arkansas, you must submit the Certificate of Organization for a Series Limited Liability Company to the Arkansas Secretary of State, as well as a Protected Series Designation for each protected series you form. You can file these documents by mail or in person. The Certificate of Organization for a Series LLC and a Protected Series Designation each cost $50 to file. Once filed with the state, these documents officially create your Arkansas Series LLC. However, completely preparing your new company to do business involves several additional steps.

Arkansas Series LLC Guide:

- Understand the Arkansas Series LLC

- File AR Series LLC Certificate of Organization

- Submit Protected Series Designation

- File or Update BOI Report

- Create AR Series LLC Operating Agreement

- Get Federal EINs from the IRS

- Open Bank Accounts for your AR Series LLC

- Obtain Any Required Business Licenses

- File the Arkansas Franchise Tax

What is an Arkansas Series LLC?

A Series LLC is a type of business entity that allows the separation of assets between “cells” or “series” within a single LLC. This allows each series to be protected from the liabilities of the other divisions. Basically, if one of the divisions faces financial penalties or legal action, neither the parent LLC nor any of the other divisions can be held liable—assuming the parent and each series has been conducting business separately and with different owners, managing their own assets and debt.

For example, someone who owns several rental homes may want to create individual series for each property. This would protect each rental home as a series, and keep them from being held responsible for any liabilities associated with one of the other properties.

Series LLC vs Protected Series

In Arkansas, the term “Series LLC” applies to an LLC that has at least one Protected Series. In other states, this is sometimes called an umbrella or parent LLC. Each protected series within the Series LLC is the equivalent of what some other states call a “series,” “cell” or “child LLC.” You can form a Protected Series by filing a Protected Series Designation, or dissolve a protected series by filing the Articles of Dissolution for a protected series within your registered Series LLC.

Learn about the Series LLC business structure in general, which states allow it, and the main steps involved in starting a Series LLC at Northwest’s Series LLC Guide.

Arkansas Series LLC Certificate of Organization Requirements

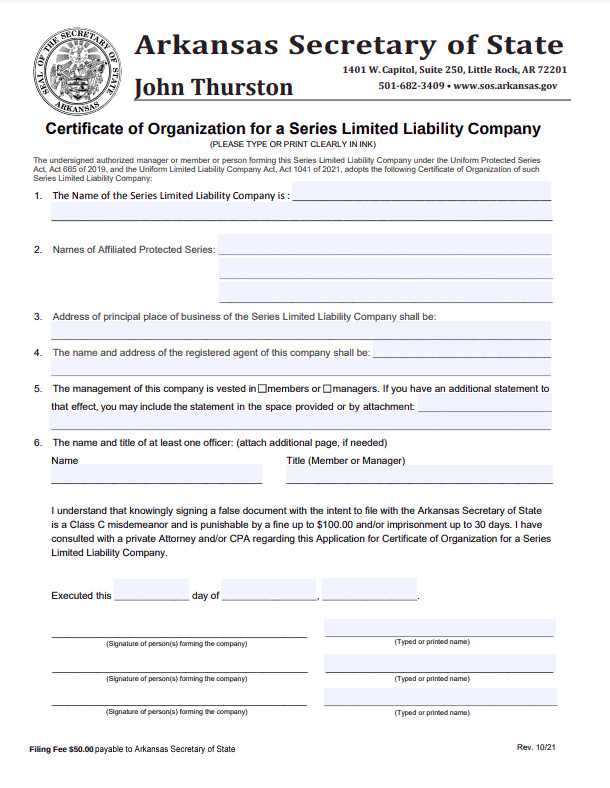

To form an Arkansas Series LLC, you must first submit the Arkansas Certificate of Organization for a Series Limited Liability Company to the Arkansas Secretary of State. See the document below and the instructions for how to fill it out.

How much does it cost to start an Arkansas Series LLC?

The Arkansas Secretary of State charges a $50 fee to file your Certificate of Organization for a Series LLC. You will also be required to pay a $50 filing fee for each Protected Series Designation you file. You will need to file one designation per Protected Series. The Arkansas Secretary of State does not accept these filings through their online portal. Instead, you must submit them in person or through the mail.

How long does it take to form an Arkansas Series LLC?

Both forms, the Certificate of Organization and the Protected Series Designation, are available on the Arkansas Secretary of State’s Website but cannot be submitted online. Forms that are mailed in are typically processed within three days of being received.

Does an Arkansas Series LLC need a registered agent?

Yes. Per AR Code § 4-20-105, you’re required to appoint a registered agent with a permanent address in the state of Arkansas for your Series LLC. Whoever you chose as your registered agent will also be registered agent for each of your Protected Series. This means you’ll need an adult individual or registered agent service who can accept service of process for your Series LLC and any of its Protected Series during normal business hours.

Learn more about Arkansas Registered Agents.

How do I add a Protected Series to my Arkansas Series LLC after it’s formed?

While you need at least one Protected Series when you form you series LLC, you can also add more Protected Series later on by submitting another Protected Series Designation application.

Arkansas Protected Series Designation Application

Your Arkansas Series LLC can add a Protected Series by filing a Protected Series Designation application, or remove a protected series by filing a Protected Series Dissolution application. Whether you’re creating or dissolving a Protected Series, you must file an application for each Protected Series individually. Each form costs $50 to file with the Arkansas Secretary of State.

The requirements for the Arkansas Protected Series Designation are similar to the Arkansas Certificate of Organization for a Series Limited Liability Company. You are required to include:

- The name of your Protected Series

- The name of the Series LLC it’s affiliated with

- The address of the Protected Series’s principal place of business

- The name and address of your registered agent (the same agent used by the Series LLC)

- Designation of management (note that instructions state that if manager-managed, you must also provide a statement listing all managers)

- The name and title of at least one officer

- Signatures of those forming the company

- Contact information for the Protected Series Franchise Contact Sheet

Remember, the name of your Protected Series must begin with the name of your Series LLC, include the phrase “protected series,” “P.S.,” or “PS,” and a unique identifier after the Series LLC name.

File or Update BOI Report

The BOI Report is a federally-mandated filing for (nearly) all businesses operating in the U.S. Unless you qualify for one of the 23 BOI exemptions, you’ll need to file your report within 90 days of forming your series LLC . (This drops down to 30 days in 2025.) The good news? You only have to file once for your series LLC, regardless of how many child pages you acquire. Just make sure to update any pertinent information within 30 days. The better news? We can file for you with our secure BOI Reporting Service.

Arkansas Series LLC Operating Agreement

Your Series LLC’s operating agreement is an internal document that establishes how your Series LLC will run. The state of Arkansas does not specifically require your Series LLC to create one—however, it is strongly encouraged. Your operating agreement will lay out important business details, like how the business will handle internal disputes and adding members, which members are affiliated with which Protected Series, and the relations among the Protected Series and the Series LLC. Basically, the operating agreement you create is your Series LLC’s contract with itself.

Creating an effective operating agreement from scratch isn’t easy. This is why Northwest provides a general template for crafting an LLC operating agreement that you can adapt to the needs of your Arkansas Series LLC. Check out this and other free and adaptable LLC forms below:

Federal EINs from the IRS

Does my Series LLC need a Federal EIN?

Yes. You’ll need a federal employer identification number (FEIN or EIN) if you’re going to hire employees, and some tax elections and licensing applications will require an EIN as well. Most banks will also require your Series LLC’s EIN to open a bank account. You can apply for an EIN through the IRS website, by fax, or by mail.

Should I get a separate EIN for each series in my Series LLC?

Absolutely. If you’d like each Protected Series within your Arkansas Series LLC to open its own bank account, you’ll need to apply for an EIN for each. In order for your Series LLC to work the way it’s intended to, you’ll need to keep the finances of each Protected Series separate from your Series LLC.

Open Bank Accounts for your Arkansas Series LLC

To open a bank account for your Arkansas Series LLC, you’ll need a copy of your Arkansas Certificate of Organization, your Series LLC’s EIN, and possibly your operating agreement (depending on which bank you’re trying to open an account with). If your Arkansas Series LLC has multiple members, you may consider bringing an LLC resolution to open a bank account that states the person working with the bank has been authorized by the LLC’s members to open a bank account in the name of the LLC.

Should I open separate bank accounts for each Protected Series?

The short answer: Yes.

The longer answer: Opening separate bank accounts for each Protected Series, as well as keeping all finances separate, is absolutely crucial to maintaining each Protected Series’s limited liability. Most of the time this means keeping separate bank accounts.

Something to consider is that individual bank accounts for each Protected Series within your Series LLC can sometimes pose a bit of a challenge. Many banks are not familiar with starting multiple, independent bank account for what can appear on paper to look like a single organization. To save yourself some time and frustration, be sure to call whichever bank you’re interested in doing business with ahead of time to explain your situation and gauge whether or not the bank will work with you.

Required Business Licenses

The state of Arkansas does not have a state-wide business license requirement. However, you may still be required to apply for a business license or permit with the state depending on what type of business you’re running. Occupational licenses and permits are required for everything from hair-stylists to personal trainers. And some licenses and/or permits are required if your business is responsible for certain environmental impacts, such as a production or waste or pollutants.

Arkansas Franchise Tax Report

Arkansas requires every LLC to file a franchise tax report each year. And yes, even Arkansas Series LLCs have to file an annual franchise tax report like any other Arkansas LLC. The name implies that this is a tax—and it is—but instead of paying a certain percentage of your income, it’s a flat fee. The report itself is mostly used to update information about your business so the state is up to date on information like who is currently in charge and how best to contact your business. Keep in mind that your Series LLC and/or Protected Series may also be subject to sales tax, property taxes, and more.

You will need to file an Arkansas Franchise Tax Report for your Series LLC and for every Protected Series you’ve created. On the Series LLC report, it’s important that you include the names of each designated Protected Series affiliated with your Series LLC, unless they’ve been dissolved. The fee for the report is $150 and is due May 1st of every year.

Be wary of submitting your report late. Arkansas charges a $25 penalty for late Franchise Tax reports, as well as 10% interest on the total amount owed to the state. If you still decide not to file your report and pay the fees, it won’t just go away. Interest will continue to accrue every year until the penalty equals two times the original amount due.