Capital Contribution Agreement for LLCs

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions—these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on. Because contributed capital affects LLC ownership percentages, changes should be documented in a capital contribution agreement. We provide a free LLC capital contribution agreement template that can be used for both initial and additional capital contributions.

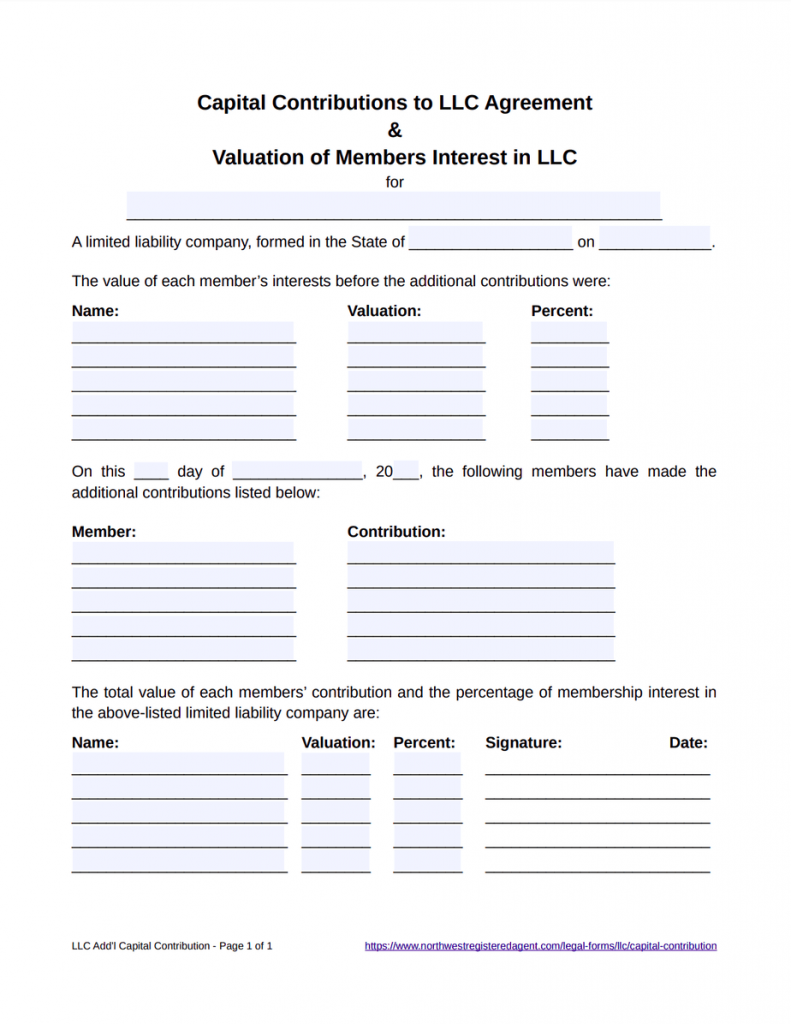

What does an LLC capital contribution agreement include?

Any contributions to capital should be documented. You’ll want to be sure to include previous and new valuations and ownership percentages, signatures and more. Our LLC capital contribution agreement documents the following essential information:

-

Name of each member making a contribution

-

The valuation of previous membership interests

-

Each member’s previous percentage of LLC ownership

-

The date contributions are being made

-

The LLC name

-

The LLC date and state of formation

-

Each member’s new contributions

-

The new valuation of each member’s total capital after contributions

-

The new ownership percentage of each member after contributions

-

Signatures of contributing members

Documenting capital contributions is just a small part of maintaining your LLC. At Northwest, we can help you with much more. We offer registered agent service for LLCs in every state for $125 a year. You can even hire us for state annual report compliance. Still getting started? We form LLCs for $100 plus state fees.

Let Us Help You Maintain Your LLC!