Free LLC Capital Contribution of Assets Bill of Sale

Contributions to the capital of an LLC are made with cash or assets. When funding an LLC with assets held in personal names, it’s best to actually sell the assets to the LLC in exchange for membership interests. You’ll want to document the value and transfer of the assets in a bill of sale. Funding your LLC with assets? Document these contributions with our free LLC capital contribution of assets bill of sale template.

How do I fund an LLC with assets?

When you start an LLC, the company needs to be funded by its members. Each member contributes to the initial capital of the LLC in exchange for membership interest. Members can also make additional contributions later on. While cash contributions are common, some members choose to contribute assets, such as property or equipment.

To function as capital, these assets first need to be assigned a value. Note that assets must receive a fair market value, and members must agree on the value—so, no claiming that your old desktop computer is worth $10K. Once members agree on the value of the assets, that value can be exchanged for membership interest in the LLC.

So how do you actually document asset value and make the transfer? With a bill of sale.

What should a bill of sale include?

There a few key points a bill of sale for capital contribution of assets should include. In particular, establishing a clear date for when assets are transferred to an LLC will help you immensely if a timeline ever comes into question.

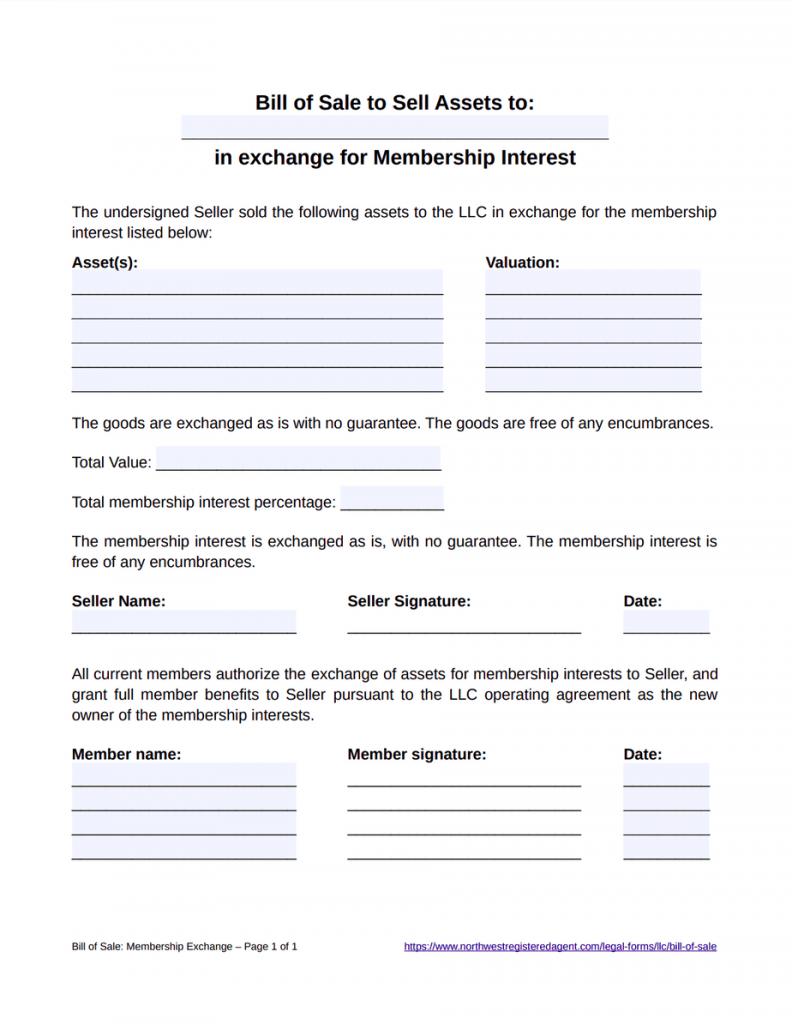

Our bill of sale template documents crucial information including:

-

Name of the LLC

-

Description of each asset and its agreed-upon value

-

Statement that goods are sold as is with no guarantee

-

Statement that goods are free of encumbrances

-

Total value of all assets being exchanged for interest

-

Total percentage of membership interest received in exchange

-

Seller’s name and signature

-

Date contributions were made

-

Names and signatures of the other members of the LLC

In addition to the loads of forms and templates we offer, we can help with your LLC in other ways as well. We offer expert registered agent service for LLCs in every state, and we form LLCs for $100 plus state fees.

Start Your LLC Today!