Free California Public Benefit Corporation Articles

A California public benefit corporation should be only used if you want to qualify for 501 c 3 tax exempt status with the IRS. Public benefit means that anyone, the entire public, could benefit from the actions and purpose of your California nonprofit. California does not provide articles of incorporation for a public benefit corporation. Please enjoy our free CA public benefit articles that already have all the tax exempt language on them.

Free California Public Benefit Corporation Articles

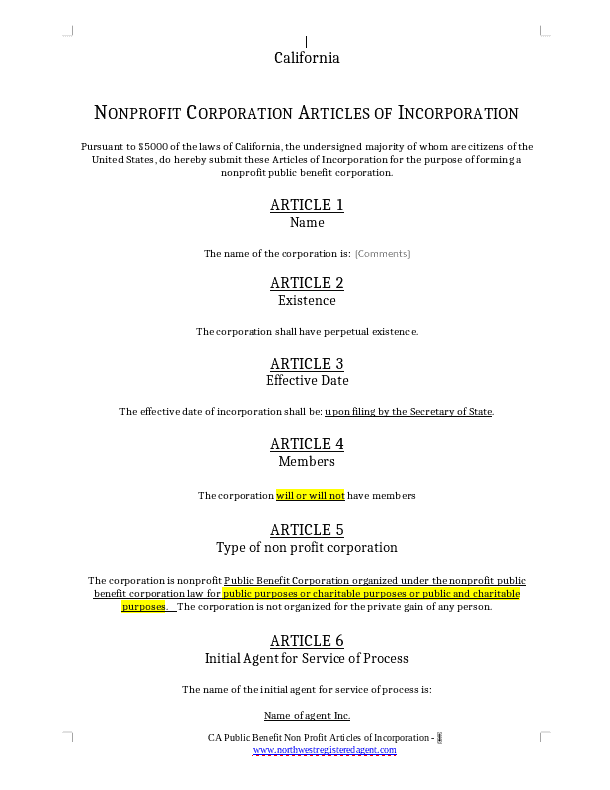

Our California Public Benefit Corporation Articles

Please note a couple items highlighted in yellow.

Article 4, you need to decide if you want or do not want members.

Article 5, you need to decide if it will be for public purposes, charitable purposes, or public and charitable purposes.

Article 10 is very important. We’ve put in the proper language to become tax exempt and gain 501c3 status, but you still have to have a good purpose. We’ve given you three questions to answer in your purpose, highlighted in yellow.

Once you’re done filling out the highlighted parts, just copy the language and go to the top of word and unclick the yellow highlight button to un-highlight them.

These California public benefit nonprofit articles of incorporation should be approved by the state, but as you can see, you still need to fill in specific areas. If you do not want to do the filing, we charge $100 to file your CA nonprofit for you.

We hope you will decide to do the filing yourself and use us as your California registered agent. You’ll need an agent for service of process anyway, and you can see our pitch below on how we will make forming and maintaining your CA nonprofit easier, just with our free nonprofit compliance tools.