Free Nonprofit Articles Of Incorporation

As you may be finding out, no secretary of state or corporations division provides an articles of incorporation template that has 501(c)(3) tax exemption language on it in a usable format. In fact, no website, period, provides this for free. You’ll find our free nonprofit articles of incorporation template in a usable word doc format below. The template already has the IRS required language to incorporate your nonprofit according to tax exempt regulations.

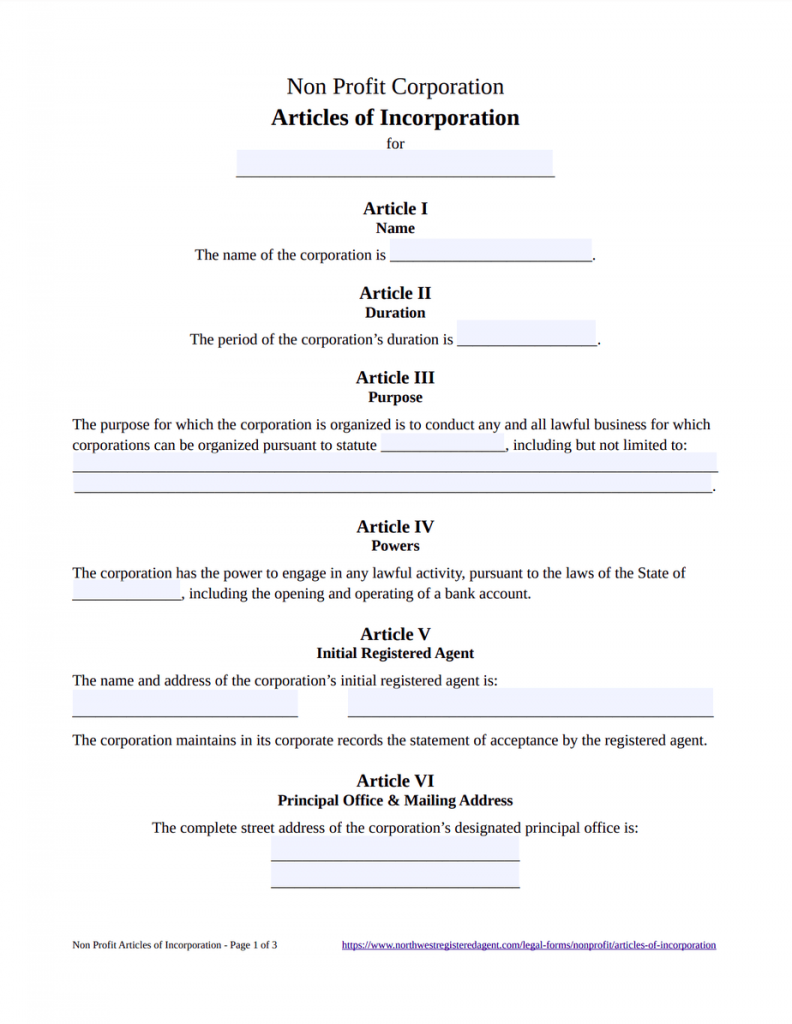

Free Nonprofit Articles With 501c3 Language

The one thing to remember is that this is a generic nonprofit incorporation template. Please either take a look at our state resources page and pull up the template the state provides, which will have a couple state specific items but no tax exemption language, OR an easier option is to just sign up for our registered agent service in the state you are incorporating in. You’ll see the nonprofit form the state provides in your online registered agent account. You can compare that with this 501(c)(3) template and follow the filing instructions in your account to incorporate your nonprofit.

Start Your Nonprofit Today!

What should Nonprofit Articles of Incorporation include?

While the exact requirements for Nonprofit Articles of Incorporation vary from state to state, the states share certain basic requirements in common—such as including the organization’s name and registered agent information. Our free Nonprofit Articles of Incorporation template includes the most common details, and you can adapt or customize the template to suit your nonprofit’s specific needs.

Article 1: Name

Common state requirements include ending the name with a corporate suffix (“corporation,” “inc.,” etc.) and avoiding names that might mislead consumers about your nonprofit’s purpose, but it’s always best to check your state’s specific requirements. The state must be able to tell the difference between your nonprofit’s name and the names of other businesses on the state’s records. Fortunately, you can do a business name search to check for your name’s availability in advance of filing.

Article 2: Existence

Your nonprofit can exist perpetually (without a specific end in sight) or have a fixed period of duration. Most nonprofits choose to exist perpetually.

Article 3: Effective Date

Your nonprofit’s effective date is the date of its official creation. In most cases, a nonprofit’s effective date is the same as its filing date—the date the state processes and approves the Nonprofit Articles of Incorporation—but some states allow nonprofits to choose a delayed effective date (usually up to 60 or 90 days, depending on the state, though some dates don’t allow delayed effective dates at all).

Article 4: Members

This article states if your nonprofit corporation will or will not have members. A member is an individual or business entity with a formal relationship to a nonprofit corporation that often includes the right to vote for directors and to otherwise weigh in on other major organizational decisions (selling off assets, for instance, or merging the nonprofit with another organization), though some nonprofits have nonvoting members, and many nonprofits don’t have members at all.

Article 5: Type of Nonprofit Corporation

This article identifies the type of nonprofit corporation you intend to form: a public benefit corporation, a mutual benefit corporation, or a religious corporation.

Article 6: Registered Agent and Office

Your registered agent is the individual or business authorized to receive service of process (legal notices) on behalf of your nonprofit. Your Nonprofit Articles of Incorporation must include the registered agent’s name (or the name of your registered agent service) and a physical location in the state, called the registered office, where the registered agent will be available during normal business hours to receive service of process and other official state documents. Many nonprofits choose to hire a registered agent service like Northwest.

Article 7: Principal Office

Your nonprofit’s principal office is merely its principal place of business—its official address—and most states require listing a street address (though it usually doesn’t need to be in the state where you’re forming your nonprofit).

Article 8: Mailing Address

If your nonprofit’s mailing address is different from the street address of its principal office, include that address here.

Article 9: Directors

List the names and addresses of your nonprofit’s initial directors. The states vary when it comes to how many initial directors a nonprofit has to have when incorporating, but three is a common number.

Article 10: Indemnification

This article secures the nonprofit’s directors, officers, incorporators, members, and employees against personal liability for your nonprofit, so long as their actions are legal and in good faith.

Article 11: Purpose

This article describes your nonprofit’s purpose. If your nonprofit intends to seek 501(c)(3) federal tax-exempt status, its statement of purpose must contain specific special tax-exempt language required by the IRS—language already included in Northwest’s free Nonprofit Articles of Incorporation template. In general, 501(c)(3) status describes public or private charities focused on the pursuit of charitable, religious, educational, or scientific goals.

Article 12: Prohibited Activities

If your nonprofit wants to qualify as a 501(c)(3) tax exempt organization, it must permanently dedicate its income and assets to IRS-approved nonprofit purposes (apart from reasonably compensating individuals for services rendered), ensure that lobbying never makes up a substantial part of the organization’s activities, and avoid political campaign activism altogether. This article includes specific IRS language limiting or disallowing these activities.

Article 13: Distributions Upon Dissolution

Nonprofits seeking 501(c)(3) tax-exempt status must ensure that their income and assets never go toward personally enriching their directors, officers, members, or any other individual—and this includes if or when the nonprofit shuts down. This article—the dissolution clause—ensures that, apart from paying its debts, any distributions made in the event of the nonprofit’s dissolution will go toward furthering its nonprofit goals or get distributed to the federal, state, or local governments exclusively for the public benefit.

Article 14: Incorporator

Your nonprofit’s incorporator is simply the individual who completes, signs, and dates your Nonprofit Articles of Incorporation, and this article includes the incorporator’s name, address, and signature. The incorporator doesn’t need to be one of your nonprofit’s members, directors, officers, or employees. When you hire a Northwest to incorporate your nonprofit, we’ll be your incorporator.

Are Nonprofit Articles of Incorporation requirements the same in each state?

No. Each state determines its own requirements for Nonprofit Articles of Incorporation. You can typically find this information on your state department’s website, but Northwest has already done the research for you. Check out our Start a Nonprofit Guide, and select your state to view our individual state nonprofit pages.

What is the process for filing Nonprofit Articles of Incorporation?

Nonprofit Articles of Incorporation get filed at the state level in the US—typically with the office of the secretary of state or an equivalent state agency. Once the state approves your nonprofit’s articles, the organization officially exists, but that doesn’t mean it’s quite ready to pursue its mission. You’ll still need to get a federal EIN from the IRS, open a bank account, obtain any required state licenses and permits, apply for 501(c)(3) status with the IRS (if applicable), and possibly register as a charity. Most states also require annual reports and other annual or periodic filings to stay in good standing.