Register a Foreign Nonprofit in Oregon

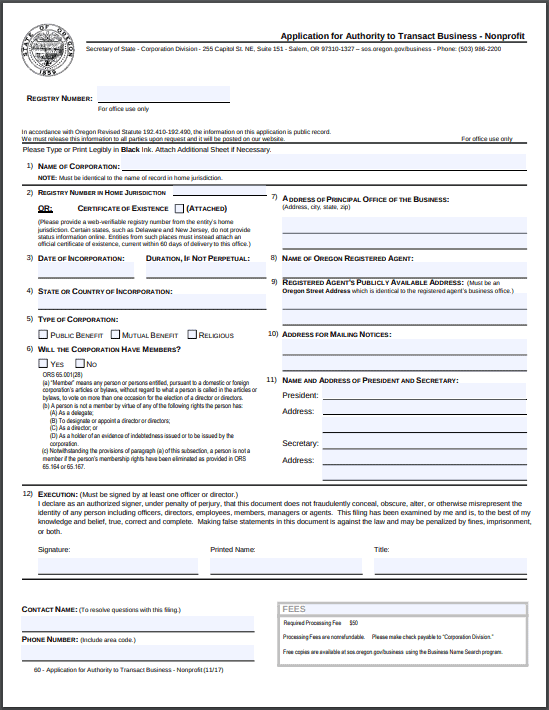

To register a foreign nonprofit in the State of Oregon, you must file an Application for Authority with the Oregon Secretary of State. You can submit this document by mail, by fax, or online. The Application for Authority for an Oregon foreign nonprofit corporation costs $50 to file. Below, we cover the most frequently asked questions about how to file the Application for Authority and register a foreign nonprofit in Oregon. Or, you can simply sign up for our Oregon Foreign Nonprofit service, and we’ll take care of your registration ourselves!

Application for Authority

Register your Oregon foreign nonprofit by filing an Application for Authority

Do It Yourself Online

Our free account and tools will walk you through registering your Foreign Nonprofit in Oregon. All for free.

When You Want More, Get More

Hire Northwest and let an expert register your Foreign Nonprofit in Oregon. Includes 1 year of registered agent service.

Free Guide to Registering a Foreign Nonprofit in Oregon

Do I need to register before conducting affairs in Oregon?

Yes, you will need to be authorized by the Oregon Secretary of State. File an Application for Authority to transact business – Nonprofit form by mail, fax or online.

Is there a fee?

There is a $50 fee.

Will I need to file an annual report?

Yes. It will cost $50 to submit.

Will I need to provide a Certificate of Good Standing?

You are required to submit a Certificate of Good Standing along with the Application for Authority to Transact Business – Nonprofit form. The certificate has to be current within 60 days of delivery along with the Application.

Are foreign non-profit organizations required to register as a charity in OR?

Before soliciting contributions or conducting affairs in OR your foreign non-profit organization will need to register with the Oregon Department of Justice by filing the Registration for Charitable Organizations form.

Am I required to file an annual report with the Department of Justice as well?

Organizations that are registered with the Oregon Department of Justice will also be required to submit an annual report. Make sure the report is received by the Department within four months and fifteen days after the end of your foreign non-profit’s accounting period.

Where do I send my annual report for the Department of Justice?

1515 SW 5th Avenue, Suite 410

Portland, OR 97201-5451

Will I need an Oregon registered agent?

Yes, it is required for your foreign nonprofit organization to have an Oregon-based registered agent with an Oregon street address. Northwest Registered Agent will gladly provide that service for you, starting at only $125 per year.

Additional Resources:

Certificate of Good Standing

Oregon Annual Report

Oregon Registered Agent

Oregon Taxes

Oregon Withdraw Foreign Corporation

Oregon LLC

Registered Agent Service