Register a Foreign Nonprofit in Nevada

To register a foreign nonprofit in the State of Nevada, you must file the Qualification to do Business in Nevada. You can submit this document by mail, by fax, or in person. The Qualification to do Business in Nevada for a Nevada foreign nonprofit corporation costs $100 to file. This includes the fee for the Initial List of Officers and Directors. Below, we cover the most frequently asked questions about how to file the Qualification to do Business in Nevada and register a foreign nonprofit in Nevada. Or, you can simply sign up for our Nevada Foreign Nonprofit service, and we’ll take care of your registration ourselves!

Free PDF Download

Download the Nevada Qualification to do Business in Nevada. Fill out the form and submit it to the state.

Do It Yourself Online

Our free account and tools will walk you through registering your Foreign Nonprofit in Nevada. All for free.

When You Want More, Get More

Hire Northwest and let an expert register your Foreign Nonprofit in Nevada. Includes 1 year of registered agent service.

Free Guide To Registering A Foreign Nonprofit in Nevada

How do I register my foreign non profit corporation in Nevada?

To register a foreign non profit in Nevada, you file the Qualification to do Business in Nevada form with the Nevada Secretary of State. You can file online or deliver your paper form by mail, fax or in person with a certificate of good standing from the home state and the filing fee. This is the same form as a foreign profit corporation would use. You check the box indicating your corporation is [nonprofit non-stock.] With your filing, include the Customer Order Instructions.

What is the cost to register a foreign nonprofit in Nevada?

The filing fee is $100 ($50 for the Qualification to Do Business and $50 for the Initial List of Officers and Directors). Pay with a check, money order or credit card. Use the ePayment Checklist when paying by credit card for paper filings.

Note that these are the fees for standard nonprofit corporations adhering to the Nevada Revised Statutes, Chapter 82. Other types of foreign nonprofits may be subject to additional fees. For example, nonprofit cooperatives and unincorporated nonprofit associations are not specifically exempt from the state business license ($200 a year) and would have to qualify for and submit a notarized Declaration of Eligibility for State Business License Exemption to receive exemption.

How long does it take for Nevada to process my foreign qualification?

The state processes online applications within around one day of receiving them. For paper filings, the state will take around seven days to process your application once they receive it, unless you pay the $75 one-day expedite fee.

How current does your certificate of good standing need to be?

90 days.

Will I need a Nevada Registered Agent for my foreign nonprofit?

Yes, you will need to name a Nevada registered agent with a physical address. If you hire ‘Northwest’, you will have an online account with the all the forms you need to file already prepopulated with our info. You also get annual report reminders and all documents that we receive for you will be uploaded for you to view immediately.

Does the Nevada registered agent have to sign my foreign qualification?

Yes, but it doesn’t need to be original.

How will Nevada return my processed filing?

One file stamped copy of your qualification will be mailed to you for free. Depending on your Customer Order Instructions, you could receive your copy by email or fax also.

Are there any annual report requirements for foreign nonprofits in Nevada?

Yes, you must file an initial list of officers the end of the month after filing and then annually by the end of your anniversary month. There is a $25 report fee. These Nevada annual reports are best filed online. See our link below.

Are there any weird things about qualifying in Nevada?

Yes! Nevada requires all foreign corporations to publish an annual statement of business in two issues of a Nevada newspaper by March 31st each year. Keep an affidavit of publication in your organization records in case the attorney general or the secretary of state asks for it. There is a $100 per month penalty for not publishing. Most Nevada legal journals and newspapers have an online sign up for this statement, which costs approximately $25. See our guide on how to publish an annual statement in Nevada.

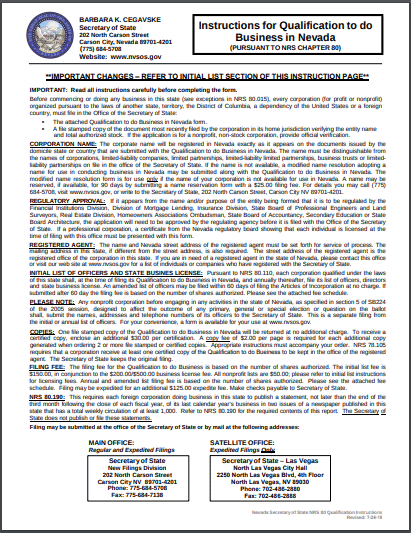

File with:

Nevada Secretary of State

New Filings Division

204 North Carson Street, Suite 4

Carson City, NV 89701-4520

Phone: (775) 684-5708

Fax #: (775) 684-7138

Why us?

Our registered agent industry on a monthly basis. You’ll have what you need to make the filing yourself in your account, or you can hire us to do the filing for you.