Register a Foreign Nonprofit in Nebraska

To register a foreign nonprofit in the State of Nebraska, you must file an Application for Certificate of Authority to Transact Business with the Nebraska Secretary of State. You can submit this document by mail, in person, or online. The Application for Certificate of Authority to Transact Business for a Nebraska foreign nonprofit corporation costs $25 to file. Below, we cover the most frequently asked questions about how to file the Application for Certificate of Authority to Transact Business and register a foreign nonprofit in Nebraska. Or, you can simply sign up for our Nebraska Foreign Nonprofit service, and we’ll take care of your registration ourselves!

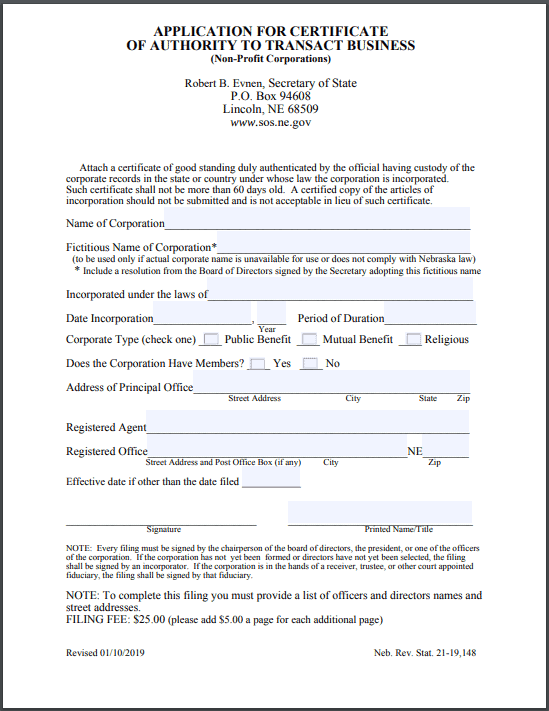

Application for Certificate of Authority to Transact Business

Register your Nebraska foreign nonprofit by filing an Application for Certificate of Authority to Transact Business.

Do It Yourself Online

Our free account and tools will walk you through registering your Foreign Nonprofit in Nebraska. All for free.

When You Want More, Get More

Hire Northwest and let an expert register your Foreign Nonprofit in Nebraska. Includes 1 year of registered agent service.

Free Guide to Registering a Foreign Nonprofit in Nebraska

How do I register my foreign non-profit corporation in Nebraska?

File the Application for Certificate of Authority to Transact Business with the Secretary of State. This form is available on the department’s website, or it’s in your online account if you registered with Northwest Registered Agent. You can either submit the form by mail, in person, or online.

What information do I need to include on the Application for Certificate of Authority?

You’re required to give the name of the corporation, the name and contact information of your registered agent, the date of the organization’s incorporation, and the filing must be signed by the chairperson of the board of directors, the president, or one of the officers. If the nonprofit corporation has not yet selected directors, one incorporator must sign the form. Also, attach a Certificate of Good Standing dated no more than 60 days prior to the date of the filing.

What’s the cost to apply for the Certificate of Authority?

The filing fee is $25. If you need to attach addendums, the fee is $5 for each additional page. You can file by mail, in person, or online.

How long does it take for Nebraska to process my Certificate of Authority?

If you file online or in person, the state will send you confirmation of your NE nonprofit corporation’s certificate of authority within a couple days of receiving your application. If you submit by mail, the process can take one to two weeks longer.

Does Nebraska require any paperwork from my home state?

Yes, when you complete the NE application for certificate of authority for your nonprofit corporation, include a Certificate of Good Standing no more than 60 days old.

Will I need a Nebraska registered agent for my foreign non-profit corporation?

Absolutely! When you hire Northwest Registered Agent as your registered agent in Nebraska, it’s a flat rate yearly price of $125 a year, you’ll have an online account that tracks your report due dates, which states you’re registered in, when your yearly service with us is up, and any documents we receive locally for you are uploaded into your account immediately for complete viewing. If or when you get served with a lawsuit, we can email up to 4 people and your attorney at the same time for real time complete viewing of a lawsuit. You’ll receive annual report reminders. It’s the same price every year, and there are no weird fees or cancellation fees.

You’ll also see all the pre-populated forms and specific filing instructions on the thank you page, in your online account.

What kinds of annual reports will I need to file for my foreign NE nonprofit corporation?

Nebraska has biennial reports, which means every two years you need to file a report with the state. This can be done online. The filing fee is $20, and reports for nonprofit corporations in Nebraska are due between January 1st and April 1st in odd-numbered years.

Additional Non-Profit Resources:

Nebraska Non-Profit Tax Exemption

Nebraska Non-profit Corporation Information:

John A. Gale, Secretary of State

Room 1301 State Capitol, P.O. Box 94608

Lincoln, NE 68509

Phone: (402) 471-4079

Website: http://www.sos.ne.gov/dyindex.html